Financial services companies have been recruiting more staff outside London for some years now, but recent figures suggest the trend is accelerating as the regions continue to gain at the UK capital’s expense.

Research by recruiters Morgan McKinley showed that hiring fell in London’s financial services sector in December last year as banks looked to recruit more employees in regional hubs. Available jobs fell 33% month-on-month and 7% year-on-year in the capital.

Morgan McKinley believes this fall does not reflect a slowdown in the sector but is part of a long-term trend towards devolution driven by technology-led cost reduction. Its figures show new financial services jobs in London tumbling from a high of around 11,000 in 2007 to just more than 4,000 in 2015.

Last October, the British Banking Association (BBA) published its report

Banking on British jobs, which revealed that banking jobs shifted from London between 2013 and 2014. Roles in the capital decreased by 4,848, while roles outside of the capital increased by 2,450.

The shift, said the BBA, was due to banks continuing to pursue cost savings in response to new regulation and rapid developments in technology.

4,000

apprenticeships created by banks between January and October 2015 were outside LondonThe BBA highlighted 77 local ‘hotspots’ where the number of banking jobs has grown faster than anywhere in London. While regional cities such as Birmingham, Edinburgh and Liverpool have been obvious beneficiaries, hotspots driving the surge in regional jobs have also included Tunbridge Wells, South Gloucestershire, Chelmsford and North Tyneside.

Yorkshire, which is home to three of the five main UK building societies with combined assets of £60bn, employs 400,000 people in financial and professional services; 30 banks have a presence in the region. The UK Government

forecasts growth in Yorkshire’s financial sector of 21% by 2022, which will require a commensurate recruitment drive to the area.

What’s more, according to the BBA, three quarters of the nearly 4,000 apprenticeships created by banks between January and October last year were outside London.

Tech trendTechnology-driven cost savings have been a big factor behind the move to the regions for some time, but the proliferation of cloud-based systems could be helping accelerate this trend in a number of ways.

In the past, financial companies needed to be geographically close to London so they could deliver important and time-sensitive documents to each other easily. Now that electronic data transfer has become a mostly reliable and sophisticated technology, this is less important. As a result, the opportunity to move large parts of an organisation to lower-cost areas has grown.

Initially, organisations looked for lower staffing and office costs abroad in countries such as Poland, India and Malaysia. Language barriers and time differences, however, have made this challenging. While offshoring still takes place, the more recent trend has been for institutions to set up in UK regions.

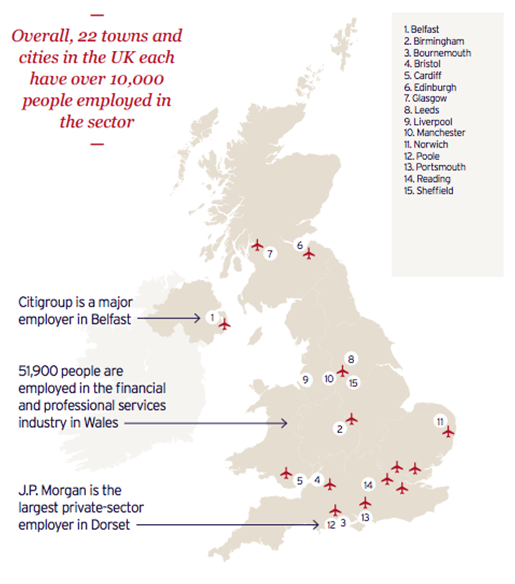

High-profile examples include J.P. Morgan’s office in Bournemouth, and Deutsche Bank and HSBC’s sites in Birmingham, but as the BBA report shows, as well as the map below taken from the Government's

UK financial centres of excellence report, many other cities and areas have profited.

Last year, J.P. Morgan announced a £28m investment in revamping its Bournemouth technology and operations centre with state-of-the-art IT. The aim was to improve communication with colleagues across the globe and to attract the best technology talent.

The Bournemouth site employs more than 4,000 people and supports 40 countries and 90 markets. Many of its staff have IT-related roles, such as in coding and programming, which are vital in the processing of huge numbers of payments and transactions around the world.

Deutsche Bank has ramped up its back office functions in Birmingham over recent years and it is starting to base more front-office staff in the city as well. In particular, Deutsche Bank's e-commerce team in Birmingham has been a key success, thanks to the popularity of telephone and internet banking.

Cost of livingHakan Enver, Operations Director at Morgan McKinley, believes this branching out of operations is no fleeting trend. “Employers are going rural, which makes sense from a cost and a recruitment point of view,” he says. “Many employees are being priced out of London, and the cost of living and quality of life can be highly attractive outside the City.

“For example, a number of the global investment banks are creating trading platforms in locations outside of London where they can trade more mainstream products at a vastly reduced cost base.

“While the advantages are mainly around cost, there are additional benefits in that setting up new business lines creates further investment in those areas and more employment opportunities for local talent.”

There are downsides too. Moving outside the capital means business centres have to communicate with their headquarters over the phone or online, but sometimes there is no substitute for a face-to-face conversation or meeting, says Enver.

Companies generally do not offer the same financial packages in the regions, he adds. This makes it harder for someone in London to relocate, though they can benefit from a lower cost of living outside the capital. Taking a wider view, Enver warns of one more pitfall – that London could lose skillsets, adversely affecting the evolution of the financial services industry in the capital.

Widening the netAnother important reason for decentralisation is that pressure on the pool of financial service professionals is forcing firms to widen their recruitment net.

Recent research by recruitment firm Robert Half UK found that 86% of financial services companies are worried about losing their top performers this year, while 99% said that finding the right professionals remains challenging. This was mainly due to a lack of technical experts (42%) and general demand outweighing supply (32%).

“Regional employees are likely to remain in their roles for longer as the competition for talent outside of London is less fierce”The research also showed that this demand is set to keep growing throughout 2016 and that, as the talent pool tightens, 89% of financial services leaders believe there are benefits to moving one or more of their business functions outside London.

Luke Davis, Vice President at Robert Half UK, notes that companies have also become less reactive and more strategic and flexible in their recruiting. “As a result, we are seeing them balance the need to access specific skillsets with developing a broader talent pool [outside London],” he says.

“As well as accessing lower remuneration costs, this move enables them to house certain skillsets together to create a centre of excellence that brings consistency of processes and expertise. Some centres of excellence have embedded themselves well by adding think tanks or innovation teams to drive greater efficiencies and strive for the highest quality.”

Davis believes that over time, this will mean that financial services operating in cities such as Birmingham, Bristol, Edinburgh and Leeds will create more career opportunities across the country.

“The challenge for recruiters is that it can be harder to identify the right skills initially out of a smaller regional talent pool. But regional employees are likely to remain in their roles for longer as the competition for talent outside of London is less fierce, and focused only on a few other firms in each region,” he says.

Traditional valuesThe return by some to more traditional, localised banking values could also contribute to the trend towards decentralisation. Civilised Investments, which plans to become Civilised Bank, is a good example. This so-called challenger bank intends to build a regional workforce over the next few years and to open offices in regional hubs.

Chairman Chris Jolly says: “In the next three years, we plan to recruit about 75 traditional, local bank managers focusing on the small to medium-sized enterprise market. They will not have branches but will visit customers. However, in about 18 months, we also envisage opening offices in regional cities to provide hubs for the bankers.

“The idea is to go back to having bankers who are experienced, know their community and local companies, and have good credit skills. But they will have a high technology base with cloud-based systems behind them. This will enable the local bankers to see everything that the bank is doing with their customers, and do all the credit work, documentation and allowances work on the same machine in real time.”

Jolly adds that banks had their reasons for centralisation, but are now realising that they have swung too far away from the understanding of local companies and local issues. “[Potential customers] have been inundating us with enquiries, because they want to be able to talk to someone who understands their business and make decisions,” he says. “That has been lost.”

It might seem like a step back, but a return to a more local focus could be the way forward for many financial services companies.