In January 2018, the

Packaged Retail and Insurance-based Investment Products (PRIIPs) regulation came into force to help retail investors understand the risks, rewards and costs of different products. Key information documents (KIDs) are a part of this regulation, aiming to help supply this data to the retail investor, increase transparency and protect them. They are a requirement for anyone who produces, advises on or sells PRIIPs to retail investors in the European Economic Area.

KIDs, and the PRIIPs regulation in general, have been met with criticism. On 28 February 2019, the FCA published a

feedback statement to its

call for input on PRIIPs. It says: “We believe that the concerns raised about uncertainty about scope and unintended effects of compliance with PRIIPs requirements are particularly serious and may risk causing consumer harm if not addressed.”

The FCA goes on to say that it is seeking and encouraging swift and effective action from EU institutions in these areas. “We will consider the extent to which domestic interpretive guidance could mitigate some of these issues.”

In September 2018, the Association of Investment Companies (AIC) published a report addressing the perceived dangers of KIDs,

Burn before reading. It says: “The reason for this chorus of concern is straightforward. KIDs mislead consumers about the products they are intended to describe.” Ian Sayers, chief executive of the AIC, has taken a clear and loud stand against KIDs – in relation to closed-ended funds – for the reasons he sets out below.

What are KIDs and why were they introduced?KIDs were intended to be a standardised document that would be sent, or provided, to retail investors when they buy a retail investment product. The document is there to try and provide some basic level standardised information that all investors should have before they make a purchase. Across three pages, it covers elements such as the investment objective and performance risk.

What are your concerns with KIDs?When the proposal for KIDs was originally mentioned, I believe most people supported the idea, but as is often the case – the devil is in the detail. The AIC has found two particular areas that it is most concerned with.

First, performance scenarios. When we saw the first examples of KIDs coming through, they showed what we consider to be an entirely misleading view of the likely returns you might get from a portfolio – far too high. In

Burn before reading [p.19], our research cites an example of one investment company KID that states that, in unfavourable markets, investors might get back 25.8% per year over the recommended holding period.

Additionally, 11% of KIDs covered in this research were showing returns of between 10% and 20% in unfavourable markets. Returns of this magnitude are not moderate.

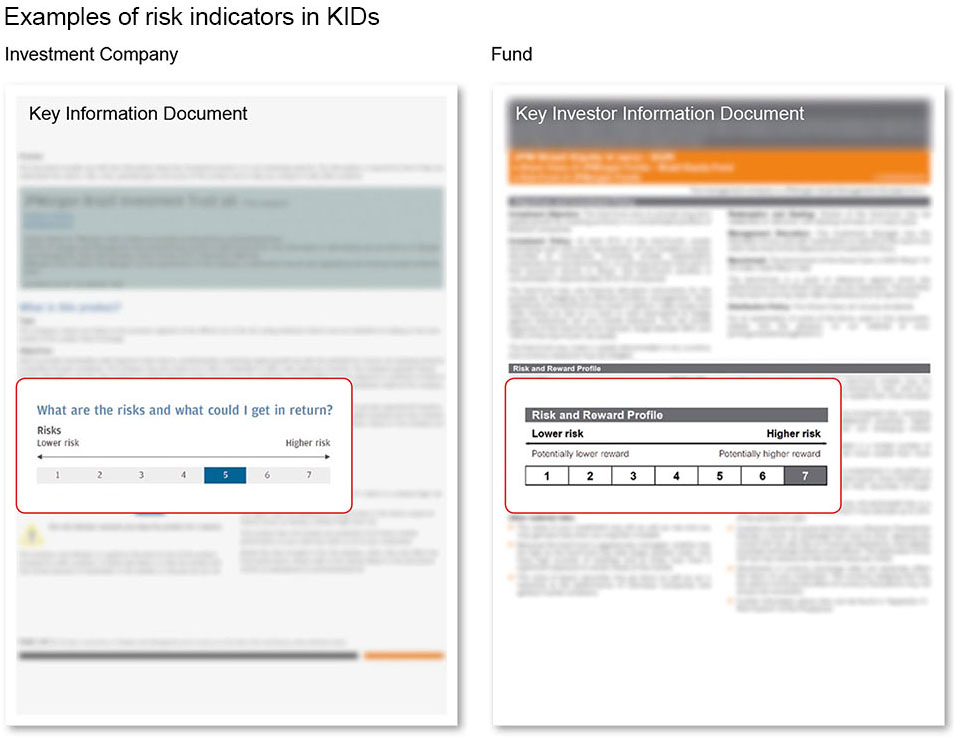

Second, risk disclosure is a major component of the KID – it shows a risk indicator (the Summary Risk Indicator or SRI) marked on a scale of one to seven. Here, there are some fundamental problems. I don't think you can communicate risk in a single number. The AIC’s research [p.9] identifies nine investment companies with a risk rating of two, which must be described as low risk. It identifies 129 investment companies with a risk rating of three, which must be described as medium-low risk.

Source: The AIC's Burn before reading

Venture Capital Trusts (VCTs) are identified as high-risk

by the Money Advice Service, but KIDs indicate that VCTs are the lowest risk of all investment company sectors – our research shows that 70% of VCTs had a risk indicator of three.

What risks do KIDs pose to clients? There’s two ways you can look at it. Imagine the consumer is thinking about an individual investment; they've already decided which fund they want to invest in and they look at the KID. I have seen some examples of these documents where the moderate scenario, which I think a consumer would see as average, is promising returns over a five-year period of over 20% per annum.

That's not what you should be telling an investor for an equity portfolio. If anyone is giving any credence to this information, they're being told this is a product that's below average risk and can perform exceptionally well. That might cause an investor to make an investment decision that they shouldn't.

The other way of looking at the issue with KIDs is through a comparative lens. If someone is comparing a closed-ended fund KID to an open-ended fund KIID (Key investor information document), they will look relatively similar on page. However, they’re worked out using different methodologies, and that information isn’t given. That's a really toxic combination for private investors.

What’s the problem with historical performance?Figures provided in a KID are based on the past five years’ performance. If a fund has performed well in the markets over the past five years, its future projections are going to be higher. If it’s had a terrible run in the markets for the past five years, the projections will be lower, possibly negative. The problem is that markets do exactly the opposite of this – funds that perform staggeringly well for a period of time could be the ones that are going to find it more difficult to repeat that in the future.

The idea that you can pick a fund and make a sensible selection based on past figures doesn’t work – history will tell you the opposite is true.

Is the whole concept of a KID flawed?No, the idea isn’t a bad one. But the use of past information to determine the future is the problem with the risk indicator and performance scenarios – it is fundamentally flawed.

It was the EU Commission that introduced the KIDs rules, not the FCA. As to why they introduced such a flawed regulation, your guess is as good as mine. They were repeatedly warned that this approach would not work. I think they may have become blinded by science and thought that simulated performance scenarios would be better than actual past performance.

Another area the AIC has concerns with is more to do with the way the rules are interpreted or implemented. For example, in the cost table element of the document, we'd like to see a bit more opportunity to be able to break down costs into individual elements. That's not a fundamental problem, that's just something you could revisit. Also, some of the disclosures in there are wordy and jargon-filled – it can be very confusing for a retail investor.

Have any of these concerns been addressed? One of the difficulties with addressing the concerns is that there are European elections approaching and making changes to the EU rulebook at this particular time is difficult. Any change can take a long time and that's part of the problem. When changes are to be made at a European level, you've got to get countries to agree and that’s a long process.

However, the EU is looking at some of the technical standards to examine whether they can be tweaked to be made better, but they can’t change the ‘headline’ rules. For example, the EU can look at how to complete a performance scenario and how it is described, but you cannot get rid of performance scenarios – there’s limited flexibility.

How should the EU commission be responding to such criticism?It should undertake a full review of all the KID rules and comprehensively reform them. In particular, it should abandon the principle of using past performance to predict the future. We also believe that it should suspend the KID rules, as misleading information should not be sent to investors. If this information is too dangerous for investors in open-ended funds, it is too dangerous for anyone.

Is there a double standard evident here? The AIC has posed this question to the FCA. If an investment manager put this information into a financial promotion – financial promotion rules state you have to be clear, fair and not misleading – I think the FCA would be extraordinarily concerned.

The European Commission is forcing the AIC and its members to make statements that we could never make on our own volition. The idea of compensation to investors if they rely on KIDs and lose money should not be a question, because it is a mandatory disclosure. It’s a very uncomfortable position to be in as this would not be allowed in a financial promotion. However, because it's in the European Commission mandatory rules, it is.

About the expert

The Association of Investment Companies (AIC) has 359 members with total assets of approximately £189bn in the UK. Ian Sayers has been its chief executive since 2010 on his promotion from deputy director general. Prior to that, Ian was the AIC’s technical director, advising members on areas such as taxation, accounting, company law and regulation.

Was the UK pressured to introduce KIDs?The AIC supported the original concept. I don’t think there was anyone saying “don’t do this” at the AIC or in the UK more generally. However, we didn’t have detailed methodologies at that stage. It was late in the process when we saw what the numbers in the document would look like. We did warn the EU commission about ten years ago not to use past performance to predict the future or try and encapsulate risk in a single figure.

What more can the FCA do to protect investors?The FCA cannot ignore these rules. But the AIC feels it could do more than it’s doing at the moment. The FCA could be clearer in its standpoint on KIDs. Its latest

call for input suggests the performance scenarios and risk indicators are misleading, but that the documents are good. The AIC believes the FCA should give more guidance on how to work with KIDs, for example, telling firms they don’t have to put the document on their websites.

What can fund managers and the AIC do to help investors?It is difficult to say, because the rules say that you can't promote other figures in preference and that's another problem with KIDs. However, it’s important to make sure that investors have all available information, such as a fact sheet and latest annual report. The AIC always advises to never make an investment decision based on a single document or single piece of data but to rather conduct a fully rounded review.

To what extent could domestic interpretive guidance mitigate the negative effect of KIDs?The impact of domestic interpretive guidance would be very limited, as the KID rules have direct force and a domestic regulator cannot override them. Guidance might help to clarify some small issues, but fundamental reform is required.

Seen a blog, news story or discussion online that you think might interest CISI members? Email bethan.rees@wardour.co.uk.