What is risk parity?Risk parity is an approach for asset allocation that focuses squarely on the efficient allocation of portfolio risk. The proposition is to move away from thinking about portfolios in terms of their capital weights and to emphasise their risk weights and exposures instead. To do that, a risk parity investor identifies the key risk factors or risk drivers of a portfolio and then allocates equal risk budgets to all of them. Risk parity portfolios tend to use leverage to scale low-risk assets, such as bonds, to the same stand-alone risk level as other asset classes (such as equities).

The risk parity approach doesn’t formally incorporate return expectations, but argues that returns naturally follow on from the structural exposure to market risks. This is in contrast to traditional mean-variance optimisation, which uses explicit risk and return estimates and formally optimises the allocation to achieve maximum expected return for a given risk budget.

Risk parity improves on some known issues with the classic mean-variance approach to portfolio construction. In particular, the traditional optimisation turns out to be very sensitive to the return estimates and often suggests very concentrated allocations – in other words, large weights in just a few asset classes. Risk parity resolves this problem by using risk estimates only. Another issue with mean-variance models is their focus on simplistic risk models. These simplifications are still made in a standard risk parity approach.

Why is it a popular alternative to other asset allocation techniques?Risk parity has established and emphasised a focus on risk (rather than capital) weights, putting diversification and non-equity return drivers at the centre of the investment process. The need for diversification is now widely accepted and should therefore be an essential consideration for every multi-asset product.

A key selling point for risk parity is that it provides an easy-to-understand and intuitive narrative to explain its investment approach, one that puts the risk and diversification focus at the core. The most powerful marketing feature of risk parity investors has been to emphasise the excessive exposure to equity risk in many institutional portfolios and balanced funds. Risk parity portfolios, by construction, appear balanced when looked at through the risk factor lens.

About the expert

Martin Dietz is responsible for the development of investment strategy in LGIM's Multi-Asset Funds team. Before joining LGIM, Dietz was a Senior Investment Consultant at Towers Watson. He has a PhD in economics and finance from the University of St Gallen, graduated from the Swiss National Bank’s doctoral program and was a visiting economics PhD student at Berkeley.A further reason for risk parity’s popularity is its performance during the credit crisis. During this period, low exposure to equities and high exposure to bonds managed to reduce the drawdowns significantly. Since then, investors have found that risk parity funds perform relatively well, as most risky assets appreciated. However, the strategy suffered from losses in mid-2013 (as bond markets sold off) and as part of the recent commodity and emerging market weakness.

How do risk parity strategies work?The key assumption of risk parity is that there is a range of risk factors that are rewarded. In fact, the approach assumes that all factors have a broadly similar risk-adjusted return over the long term. If they are all similar, then the key task for an investor is to maximise the degree of diversification available among them to manage the total portfolio risk. If the risk factors are uncorrelated, it is optimal to allocate equal risk weights to all factors.

It is important to understand the limits of this stylised concept. Finance theory argues that only systematic risk is rewarded, while idiosyncratic risks aren’t, and in a multi-factor approach, there can be several priced market factors. However, the level of confidence (or scepticism) around these factors will vary and it is not obvious that the risk-adjusted factor returns would be expected to be the same.

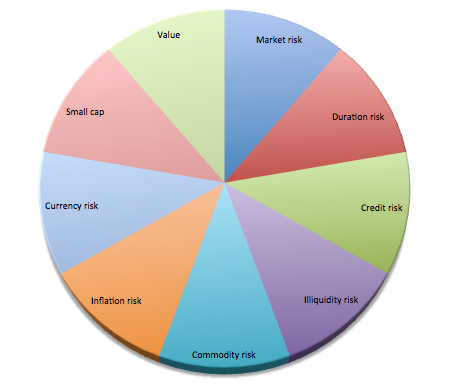

A typical portfolio that uses the risk parity approach might look similar to the one represented below

For example, there is a range of opinion about the likely reward for taking duration risk in bonds. Historic bond returns look attractive, but they were boosted by a secular fall in yields. At a time of massive demand for duration from insurance and liability-driven pension investors, it appears less likely that bonds still offer a sizeable term premium.

For example, there is a range of opinion about the likely reward for taking duration risk in bonds. Historic bond returns look attractive, but they were boosted by a secular fall in yields. At a time of massive demand for duration from insurance and liability-driven pension investors, it appears less likely that bonds still offer a sizeable term premium. Given the above concerns, it is clear that a risk parity investor needs to be careful to identify the rewarded risk factors. In all likelihood, this is not a clear cut process and there will be varying degrees of confidence in the factors. Investors may want to size the various factors in line with their confidence. This leads to a looser interpretation of the risk parity framework.

How do strategies vary?On the surface, risk parity appears as a simple and consistent framework. So it may be quite surprising for investors to see the significant deviations between risk parity approaches.

First, there can be significant differences in the use of underlying strategies or risk factors. Included strategies can range from traditional asset classes (equities, credit, bonds and so on), equity factors (small cap, value) and alternatives, all the way to systematic trading strategies (momentum, value and carry). Second, there are many variations of the portfolio construction process. Different quantitative and qualitative approaches slice and dice the available set of strategies in a different way to design the basic risk factors and combine them. LGIM's own

research has shown that small deviations in the portfolio construction approach can drive large differences in exposures.

There are also differences in the degree that funds target a constant risk or volatility level. Portfolios can be designed to be relatively structural and static in their exposures, or they can aim to achieve a constant level of fund volatility, which will require the fund exposures to be dynamically managed in line with market conditions.

Some firms claim that risk parity could make the system more fragile. Do you think this criticism is justified?This claim is mainly based on risk parity strategies that target a constant level of risk over the short term. As markets fall, volatility tends to go up, and such funds reduce capital exposure to keep risk in line with targets. This process of selling into a declining market and buying in a rising market would exacerbate market movements and market volatility.

While these risk parity strategies are clearly pro-cyclical, their actual market impact will depend on the volume of assets managed in line with the approach. Estimates differ widely, but LGIM's conclusion is that they are not sizeable enough (yet) to have a meaningful impact on markets. As with all such strategies, market impact is a concern for risk parity strategies that will need to be monitored over time.