Which financial services should newly self-employed workers consider?A big issue for self-employed workers is not trying to fill the whole workplace benefits gap, but rather making sure they are properly covered in the areas that are particularly relevant to them. The core benefits that most self-employed workers have to consider are pension provision, life assurance and income protection. Any other requirements will be dependent on the needs of the individual and what they are able to afford.

What about self-employed workers who are about to become parents? Does the market offer insurance to cover maternity and paternity leave?I’m not aware of any specific insurance that is available to cover maternity or paternity periods for self-employed workers. State benefits could be available. Self-employed women are not entitled to Statutory Maternity Pay but may be entitled to Maternity Allowance. This is a social security benefit that is payable from around the time the baby is due, for up to a maximum of 39 weeks.

For the self-employed, periods of maternity or paternity leave can hit personal finances hard, which is why people should plan ahead, keep finances as flexible as possible and ideally have a pot of money available to access when income from their business could be significantly lower.

Without access to a workplace pension, what is the best way for a self-employed person to save for retirement? In theory, self-employed workers should be investing a significant proportion of their earnings into a private pension to provide for their retirement. The amount people should be saving will depend on their age, income and circumstances. Ideally, self-employed people will be saving up to 20% of their earnings, especially as they won’t be benefiting from any employer contributions.

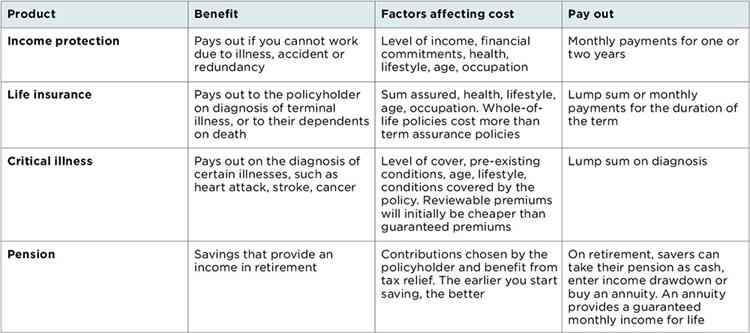

Key financial products for the self-employed

Key financial products for the self-employed

However, the reality is that too many of the self-employed are not saving enough, or are saving nothing at all, for their futures. There are a couple of reasons why self-employed workers tend not to invest into pensions. The first of these is to keep their finances flexible and not lock money away in a pension fund that they will be unable to access until they reach retirement age.

Second, the self-employed are not currently included in pension auto-enrolment, where eligible employees are automatically put into a company pension scheme. This means they are fully responsible for setting up and contributing to their own pension arrangements and other, more immediate financial concerns, can easily take priority.

4.75 million

The number of UK workers who are now self-employed, compared with 3.8 million in 2008

For most people, the best approach to long-term savings is a combination of pensions and Individual Savings Accounts (ISAs). Self-employed workers with irregular earnings might favour the added flexibility of ISAs so that they can access their money whenever they want to. For those with more stable earnings, pensions are likely to be preferred as they can benefit from initial tax relief and still access their defined contribution pension from age 55 if it is needed.

What are the types of pensions available to the self-employed, and how much might they typically cost?Without a workplace pension being available, the options are typically a stakeholder pension, personal pension or self-invested personal pension, the same as for an employee. The right option will depend on the amount of flexibility that the person wants in terms of the funds they would like to invest in when they are younger and, potentially, in terms of how they decide to take pension benefits when they get older.

For many, the starting point could be a personal pension. Annual charges, including fund and wrapper costs, should be less than 1% of the value of the fund per annum. Many personal pensions also have between 100 and 300 external fund links if you want them, although these are likely to come with higher charges.

What is the best way a self-employed worker could protect their family, should the worst happen?Take out life cover, the amount and type of which should be aligned to their personal circumstances. Do they need life cover to financially support a spouse, partner or children if they were to die or, for example, to pay off a mortgage or other debt?

About the expert

Patrick Connolly is a CERTIFIED FINANCIAL PLANNERTM professional at Chase de Vere. Chase de Vere is a national firm with more than 200 qualified independent financial advisers. It has offices throughout the UK.

Patrick Connolly is a CERTIFIED FINANCIAL PLANNERTM professional at Chase de Vere. Chase de Vere is a national firm with more than 200 qualified independent financial advisers. It has offices throughout the UK.

Many employers typically provide employees with life assurance equivalent to three to four times their salary. Self-employed people might have to make a compromise between the level and type of life cover they want, and how much they can get, based on their circumstances and the amount they can afford to pay in premiums. Because of this, it’s difficult to identify a ballpark cost. The best course of action is to speak to an independent financial adviser, who will be able to recommend the best product from the best adviser to meet an individual’s specific need.

How can a self-employed person plan for periods of illness?

People in this situation should consider income protection policies, which pay an ongoing income until the person is able to return to work. These policies can be set up to suit their circumstances in terms of how much income is required when they are off work, when the income payments kick in and how much they can afford to pay into the policy.

As a self-employed person, you may need to compromise by reducing your benefit amount or increasing the period of time before income benefits are paid if premium levels would otherwise be unaffordable, but this is likely to be a better solution than potentially facing an open-ended period with no income.

If people are able to build up enough cash savings, they may be able to select a longer deferred period before payments on income protection policies start, which will reduce the cost of the policy.

What are the risks for self-employed people who fail to arrange their personal finances, or make the wrong decisions when doing so?These include their business failing, personal liability for any business debts, including potentially losing their house, extended periods off work with no income, insufficient income in retirement, or their spouse, partner or children suffering financially if they were to die. This makes it essential that self-employed workers make sensible decisions regarding their personal finances, and in many situations the best way to do this is for them to take independent financial advice.