What is a dividend and who has access to them?

When you buy a share of a company, you obtain the right to share in the profits of the company after all other stakeholders have been paid out. These profits are distributed in the form of dividends (or share repurchases). But this is contingent on the company choosing to pay out a portion of its cash flows.

What is a dividend yield?

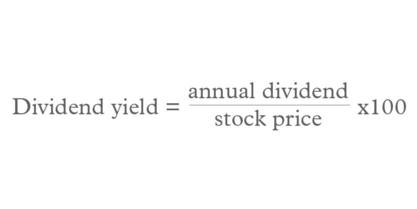

A measure of the return you get when you buy the share of a company. It is defined as the dividend paid divided by the price per share. It is not the complete return you earn, because part of the return is obtained in the form of potential capital gains when you sell the share at a higher price.

You can calculate dividend yield using the formula below:

How has the role of dividends in investment traditionally been understood?

Since companies typically have reasonably fixed dividend policies, a dividend can be considered a relatively safe asset that provides a steady cash flow – if the company has been consistently paying dividends in the past. If a company has never paid dividends, it is impossible to predict when it might start paying them.

What impact do dividends have on share price?

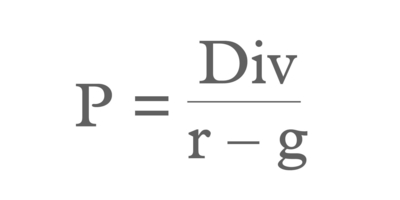

The share price of a company is usually computed as the present value of an infinite stream of cash flows in the future. It may seem odd that an infinite stream of cash flows has a finite present value, but it does. The reason is that when the cash flows go further and further into the future, the present values go closer and closer to zero. Therefore, the value is finite and is represented by a simple formula:

Where P, the share price, is the present value of future expected dividends (here assumed to be growing at a constant rate), r is the opportunity cost of capital, and g is the growth rate of dividends.

Hence when a company pays a dividend, on the ex-dividend day, the share price goes down by the amount of dividends it has just paid.

What do investors, and those less experienced, need to consider? Are there any challenges they should be aware of?

Companies have two choices with the cash flows they generate. They can pay it back to the shareholders in the form of dividends or share repurchases, or they can reinvest it in the company.

If a company is considering reinvesting the cash generated in part of the business or a project, they will calculate the internal rate of return (IRR) for the potential reinvestment. Ideally, the company would want to be earning more on the capital invested compared to the cost of any capital they raise. Therefore, the higher the IRR, the better the returns and the company may prefer to retain cash generated and reinvest the funds back into the company. In this case, theoretically no dividend will be paid, or the dividend payments will be relatively small. However, if the company establishes that the IRR of a project will be lower than the cost of capital, it might be better to pay out some of the cash flows generated to shareholders instead in the form of regular dividend payments or special dividend payments.

So, if you are buying a share of a company for the sake of its dividends, you should be aware that companies with lower internal rates of returns on their projects typically have fewer growth opportunities than younger, fast-growing companies.

Is it better to take the income or reinvest it for increased capital growth? Is there any difference?

In theory, there should be absolutely no difference between just taking the income or reinvesting it in the company for capital growth. On one hand, you are getting the income, paying taxes, and consuming the income by buying actual goods and services with it. On the other, you are getting the income, paying taxes, and then reinvesting in the same company at the current share price. But the current share price is exactly the value you will get from the company in the form of future dividends if the market is efficient. So you are just as well off as before.

What are the tax considerations?

As I mentioned, companies have two ways to pay out cash to their shareholders, either in the form of dividends or share repurchases. If a company pays out cash in the form of dividends, this is treated as ordinary income to the shareholders, who need to pay tax on this at their marginal tax rates. If a company pays out cash in the form of share repurchases, shareholders will pay tax at the capital gains rate, which in many countries is lower than the income tax rate.

Why did the UK hit historic highs in dividend yields in 2019?

There are many theories, but in reality, nobody knows. One possibility that has been mentioned in the press is that companies that made a lot of profits issued special dividends in 2019. Special dividends are extraordinary dividends that are paid outside the company's traditional dividend policy. In other words, they didn't commit the company to pay such large dividends in subsequent years.

What impact did the 2008 financial crisis have on dividends?

It depended on the type of company. A company with a large permanent fall in its cash flows is likely to lower its dividend payments in the future. However, if the cash flow deficits are expected to be temporary, the company usually dips into retained earnings to cover its dividend payments for that year. Companies that reduced dividends during the 2008 financial crisis typically expected a large drop in the value of their cash flows going forward. There was another group of companies that also reduced dividend payments. These companies had bailouts from the government ─ a company receiving a bailout and then choosing to pay dividends would have a really poor public relations fallout.

About the expert

Professor Raghavendra Rau is Sir Evelyn de Rothschild Professor of Finance at Cambridge Judge Business School. He is also a former president of the European Finance Association and a former editor of Financial Management.

He is a founder and director of the Cambridge Centre for Alternative Finance and a member of the Cambridge Corporate Governance Network. He is the author of A short introduction to corporate finance (published by Cambridge University Press), a book written for non-financial experts that explains all the fundamental concepts in finance at a basis intuitive level with minimum mathematics.

What has been the effect of Covid-19 on dividend payouts?

Bondholders of the company are an especially important group of stakeholders. They are paid before the shareholders. If the company does not have the cash to make its interest payments, and is not confident of being able to raise additional cash in the financial markets, it is quite rational for the company to cancel its dividend payments for the upcoming quarter. If it cannot make its interest payments it might have to declare bankruptcy, which is substantially more serious than maintaining a stable dividend policy. To apply this concept to the Covid-19 crisis, the markets fell quite substantially in early March 2020. For example, on 12 March 2020, the stocks dropped by over 10% in one day, the Dow Jones's worst day since 'Black Monday' in 1987. In response to this shock, several companies in the UK including Royal Dutch Shell, BT, Glencore, Shell, and most of Britain's largest banks decided to cut dividends through 2020.

In isolation, a large dividend cut spells trouble. A firm choosing to cut dividends when no one else is doing so is suggesting it is in serious trouble. However, if everybody is cancelling dividends at the same time, there is no real adverse signal by the company cutting its own dividends. This is treated as a market-wide shock that is not unique to the company, and hence the companies' shares are typically not sold off significantly.

Are dividends thought of as a 'safe asset'?

Well, sort of. Dividends are typically paid by large mature companies with few growth opportunities and stable and mature cash flows, and it is conceivable that dividends will be paid consistently over time. Buying shares in these types of companies, which have a stable and consistent dividend policy, means you are typically assured of a relatively stable income stream. The downside of obtaining this income stream, however, is the tax consequences. Overall, relying on dividends is probably less volatile than relying on capital gains. Firms with lots of growth opportunities that don't pay dividends might offer opportunities for higher returns but these returns are also likely to be more volatile.