What are convertible bonds?A convertible bond is essentially a corporate bond plus an equity call option. This combination results in a compelling risk-adjusted return profile for investors that can deliver the upside potential of equities and the downside support of bonds.

How do they work?As with conventional bonds, the holder receives regular coupons and principal at maturity. And like other bonds, the price of the convertible should not fall below the net present value (using the relevant discount rate) of those cash flows. Holders also have an equity call option, which gives the right, but not the obligation, to convert their bond cash flows into a predetermined number of the company’s shares. Therefore the price of the bond should be the higher of either the bond value (bond floor) or the value of the underlying shares. For example, a convertible bond is trading at par (£100). The investor has the right to exchange the bond cash flows (coupon and principal) into ten shares of the issuing company. If the share price is £8, the value of the equity that the convertible holder could convert into would be £80. The investor would not therefore convert. However, if the share price rallied from £8 to £16, the equity value would increase to £160. Therefore the convertible price could be at least £160 and so it could be beneficial for the holder to convert into shares.

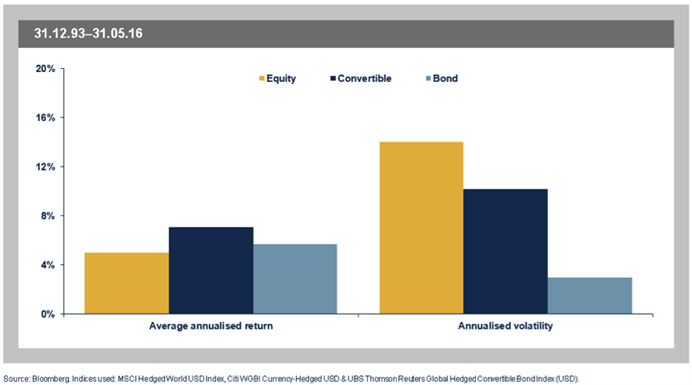

Why are they attractive, and why should they be a core allocation in a balanced portfolio?Over time, convertible bonds have delivered equity-like returns but with considerably less volatility. This combination of equity-like returns for less volatility results in an improved efficient frontier when one introduces convertible bonds to a portfolio of bonds and equities. The option component gives rise to these attractive risk-adjusted returns, producing an asymmetric return profile. Like corporate bonds, convertibles pay income to investors (though like corporate bonds, yields have fallen in recent years), but unlike bonds they have the potential to rise in price if the company’s stock performs well.

Should you invest in convertible bonds now? We would argue that equities are a more appealing asset class than straight bonds, especially in the context of such low yields on other interest rate securities, but there remains considerable risk to financial markets in general. We consider convertibles an appropriate investment vehicle for the current environment; providing conservative exposure to equities, with positive convexity due to their bond floors. Furthermore, convertible valuations are now relatively appealing both on an absolute basis and relative to equity volatility.

How do they compare in terms of risk and return with equities?Annualised return and volatility of equities, convertibles and bonds

About the expert

About the expert

Lee Manzi is a fund manager at Jupiter Asset Management.

Jupiter Asset Management is a UK-based fund management group that manages equity and bond investments for both private and institutional clients.

How does the convexity of convertible bonds differ to conventional bonds?Convexity in convertible bonds is given by the convertible price sensitivity to changes in the underlying share price, whereas convexity in conventional bonds is given by their sensitivity to a change in interest rates. The appealing characteristic of convertibles is that this sensitivity increases as share prices rise and decreases as share prices fall. This gives rise to an asymmetric return profile, something every investor would surely desire.

What are the downsides to convertible bonds?As with all bonds, convertibles are subject to credit risk. Convertible bonds are generally pari passu with other debt holders in the capital structure. Therefore if the company is unable to meet its liabilities, investors may receive less than par. If the convertible is trading at a very high price level because the underlying equity has rallied strongly, then the convertible bond will be trading a long way away from its bond floor. In this case the convertible bond price could fall significantly if the underlying equity falls, before stabilising as it reaches the bond floor.