People are living and staying healthier for longer, with older people making up a growing proportion of the workforce. The OECD

ranks the UK at 13 out of 35 countries when it comes to the proportion of older people in work. But while the nation as a whole fares reasonably well, its financial sector does not.

There are 9.4 million people working in the UK over the age of 50 – more than 30% of the working population – according to the report

Avoiding the demographic crunch: labour supply and the ageing workforce from the Chartered Institute of Personnel and Development (CIPD).

The employment rate for 50–64 year olds has been steadily rising for years. In the early 1990s it was running at around 56%, with 9% unemployed. The most recent

data from the Office of National Statistics (ONS) shows that the employment rate from December 2016 to February 2017 stood at almost 71%, with unemployment at 3.2%.

Poor retentionBut according to the CIPD report, workers in the finance and insurance sector aged 50 or older are equivalent to just 22.6% of the sector’s workforce – the second lowest proportion for any sector in the UK. Conversely, more than 30% of people working in financial services are aged under 30, which is higher than the norm.

A key factor underlying these statistics is the fact that the sector has a very poor record for retaining older workers, seeing a drop-off of 72% in the number of workers it employs in their late 40s compared to their early 60s – worse than any other part of the economy.

"What organisations need to do is to train managers to be aware of subjective decisions during recruitment. Anyone involved in hiring needs to be trained in equal opportunities"

There are many legitimate reasons why older people might drop out of the workforce. They may want to retire early, work in a different field, be their own boss, or they may suffer from ill health. But given that the finance sector rates so badly compared to most others, it seems likely there are cultural issues at play too. The CIPD suggests that the finance sector may be ill-suited to older employees, perhaps due to it being a high-stress profession, its failure to provide older employees with the continuing training they need, or because it has historically provided generous pensions, which reduces the need for people to carry on working.

Those who do continue to work into their 50s and beyond often have a different employment status to younger workers. A Department of Work & Pensions (DWP)

report notes that older workers are more likely to be self-employed than other age groups, particularly those still in work after 65. According to the DWP, there are 1.1 million workers aged 50 to 64 years in the banking, finance and insurance sector, and of them 320,000 (28.5%) are self-employed. Of the 186,000 workers aged 65 or over, 92,000 (49.5%) are self-employed.

Ageist behaviourIt is difficult to determine exactly how much of an impact age discrimination, which has been illegal in the UK since 2006, has on the figures.

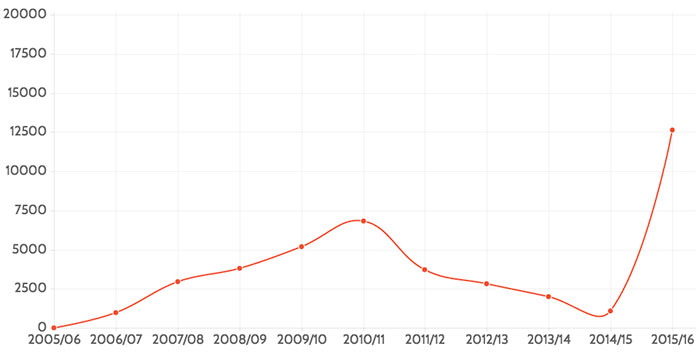

Data compiled by law firm Lewis Silkin on employment tribunal claims shows a steady rise in cases in the years after the law was changed, reaching 6,821 cases in 2010–2011. However, from 2011 onwards, claimants had to pay a fee of up to £1,200 to pursue a claim, and the number of cases fell sharply, to 1,081 in 2014–2015 (see Graph 1).

Graph 1: Employment tribunal claims (2005–2006 – 2015–2016). Image courtesy of Lewis Silkin

Note: The large spike in 2015–2016 is not indicative of a new trend. In September 2015, 11,418 age discrimination cases were submitted, and almost all of these probably relate to a large multiple claimant issue

Note: The large spike in 2015–2016 is not indicative of a new trend. In September 2015, 11,418 age discrimination cases were submitted, and almost all of these probably relate to a large multiple claimant issue

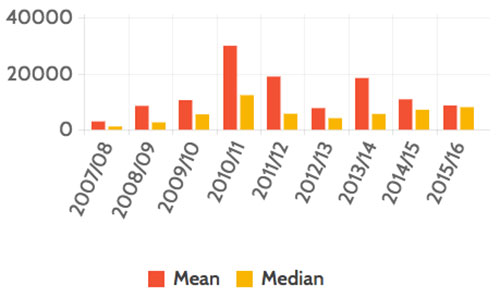

“The decline in the number of cases across the board suggests it’s the fee that’s impacting the number of cases, rather than age discrimination actually falling,” says Katrina Pritchard, associate professor at Swansea University School of Management, who helps to run the Age at Work research programme. The increase in median average compensation awards for age discrimination since the introduction of the fee, from £6,065 in 2011–2012 to £8,417 in 2015–2016 (see Graph 2), suggests that the claims brought forward have actually been stronger. Age can, however, be one of many factors in a broader discrimination claim and it is not just a problem for older workers. “There are often combinations rather than single factors,” adds Katrina. “There is gender and ethnicity discrimination. And age discrimination can apply at any age, not just for older people.”

Graph 2: Average compensation awards. Image courtesy of Lewis Silkin

The recruitment process, in particular, remains an area of concern in terms of age discrimination. “Circumvention or outright contravention of the law seems commonplace,” says Dr Ros Altmann CBE, the UK Government’s business champion for older workers, in her

Retain, retrain, recruit report. Recruitment agencies use ‘young’ language in job advertisements, such as “energetic” or “recent graduate”, while employers often specify that they will only interview younger candidates. Meanwhile, candidates who have adjusted their CVs to remove career dates, or relabelled O-levels as GCSEs, have suddenly been called for interviews following long periods of rejection.

The report’s YouGov survey reveals that 57% of out-of-work over-50s feel employers are not interested in them because of their age. “Some recruitment agencies are happy to run temporary roles past me, but are reluctant to put me forward for permanent roles,” explains a qualified accountant with over 18 years of experience, who is quoted in the report.

Recruitment drive

If the financial services sector is to address this issue, it will need to make changes to recruitment processes and develop methods to attract older applicants. While it is illegal to positively discriminate in favour of any age group, there are things that companies can do, from assessing the wording used in job advertisements to reviewing how interviews are run and candidates are picked.

“Culturally we have biases towards older and younger people,” says Rachel Suff, employment relations adviser at the CIPD. “There are assumptions that can be quite deeply held and pervasive, such as older people being slower to learn new skills. That unconscious bias can really affect people when they're recruiting. What organisations need to do is to train managers to be aware of subjective decisions during recruitment. Anyone involved in hiring needs to be trained in equal opportunities.”

It is generally better for firms to use a panel of interviewers rather than an individual when recruiting, because they can act as a check on each other, while application forms and interview questions should be audited to ensure they aren’t inadvertently discriminatory. Companies that use recruitment agencies can request to see an age-balanced pool of candidates.

Retaining top talent

Barclays

Through its Multigenerational Programme, Barclays has created opportunities for older male and female workers, and increased intergenerational understanding in the workplace, while expanding its talent pool. The initiative includes:

– A Dynamic Working programme where employees can design working patterns.

– An apprenticeship scheme, Bolder, which creates employment opportunities for older people.

– A Return to Work system for women who are resuming their careers after time away.

– A Silver Eagles scheme, which recruits retired employees to assist younger colleagues and older customers through digital skills sessions.

Lloyds

The MAXIMISE network at Lloyds was created in 2014 to support its growing number of over-50s male and female employees. The programme uses social networking, webinars and information sharing to help those working across the bank achieve a fuller working life. MAXMISE also makes employees feel valued and empowered through support with future life planning. Initiatives have included:

– Internal pension clubs with intergenerational support.

– A Menopause event, which raised awareness of a lifestyle change that will affect many female employees.

– A Planning for the Future workshop, run with Age Scotland, which offered advice on issues such as health and wellbeing, and starting a new business.

For jobseekers, the

Retain, retrain, recruit report suggests a number of methods to help older people find work. Learning new skills, particularly IT-based, carrying out relevant voluntary work, becoming proficient in social media and having a detailed and up-to-date LinkedIn profile are useful tools for the unemployed, while omitting a date of birth or dates of previous jobs on an application form can ensure the focus remains on an individual’s accomplishments as opposed to age.

Working conditions

Of course, another way to boost the number of older workers is simply to hold on to existing employees for longer. A

recent survey of HR teams in the financial services industry by recruitment consultancy HireRight finds that keeping good employees and employee turnover were named as the second highest priorities for 2017, just behind making HR processes more efficient.

Offering flexible working conditions, such as job-sharing or flexitime, could be a key factor if the financial services sector is to make progress on retaining, and employing, older workers. Among employees aged 50–64 in the finance sector, 23% of those are working part-time and 16% have flexible working conditions, while 44% say they would prefer shorter hours, according to the DWP.

Other retainment practices – including sharing best practice, training employees to manage an ageing workforce, mid-life career reviews, mentoring schemes, and retraining or skills workshops – can help companies to hold onto valuable older talent, notes the

Retain, retrain, recruit report.

Even if some firms prefer to operate with a younger workforce, the situation might not be entirely in their control. Since 2011, default retirement ages have also been abolished and, with pension schemes often now less generous than they were in the past, many people may decide to stay in work for longer.

Brexit could also alter the landscape, and it is likely to become harder for UK employers to attract talent from across Europe. “We’re already seeing a levelling off in migrants coming to this country,” Rachel says. “We’ve got very high employment at the moment, record levels of vacancies and we haven’t got a limitless supply of young people. As an employer you need to look holistically at your potential talent pool. Older workers are an obvious source of, in the main, untapped talent.”