Investors hate uncertainty. They’re not big fans of political paralysis either. So you would think that they would welcome the quick and clear result of the US presidential election but, from the east, moving west, markets fell as the world woke up to the news that Donald Trump was likely to be the next US president.

Asian markets were the first to post heavy falls and, at one point, witnessed what BBC Asia Business Correspondent Karishma Vaswani described as a “sea of red”. Japan’s Nikkei shed 5% but India’s S&P BSE Sensex fell by a more modest 1.2%.

Europe’s exchanges also reacted in a more measured way: Paris and Frankfurt were down by 1.2% and Madrid and Milan by 1.4%. After an initial fall of 1.4% on the FTSE 100 too, confidence bounced back a little and the index was down 0.2% by around midday.

Commentators are also scaling back predictions of a “Wall Street crash”. Initial estimates of a 4% dip are now coming in at around 1.5% for the Dow Jones and S&P 500 and 1.9% for the Nasdaq.

Why do markets seem relatively calm? The BBC’s Business Presenter Dominic O’Connell said the most likely explanation was confusion. “The markets know as little about a Trump presidency as anyone else, and trying to seek a safe haven when no one quite knows the direction of the world’s largest economy is tricky. Better to sit on your hands and see what happens,” he

wrote.

Investor fears

What exactly are investors waiting for? In the run-up to the election, Sky News’s

Ian King reported that a Trump victory could spell “very bad news” for the US economy. If the Republican candidate’s protectionist and anti-free trade stance were to result in actual trade barriers, American companies’ profits could take a battering as companies get hit by ‘tit-for-tat’ trade rules.

King said that household incomes could also suffer as US consumers lose the benefit of lower prices that free trade affords. And if Trump’s anti-immigration position creates skills shortages, higher prices to pay for higher wages wouldn’t be too far off.

And beyond the US, investments in emerging markets, which have benefited the most from the growth in global trade, could be hit, he said.

Sky News article

Long-term opportunitiesSome fund managers were so worried about the outcome of the election that they had ditched US stocks from their portfolios prior to yesterday's vote. But investors with a stomach for the longer term could benefit from exposure to the US.

What Investment's David Thorpe reckons this group will still be rewarded, regardless of the election outcome. He cites three investment opportunities, highlighted by Andy Parsons, Head of Investments at The Share Centre.

First, companies with a competitive advantage in products or services and with regular and growing cash flow are likely to deliver attractive returns. Second, the US has under-invested in public infrastructure and will need to spend to update it to remain competitive. And third, healthcare stocks are likely to be under the spotlight post-election. Both candidates supported a funding increase for the National Institutes of Health and reform of mental health programmes so Parsons believes healthcare is a long-term investment opportunity.

What Investment article

Broader trendsOther commentators agree that investors who can hold their nerve have nothing to fear from the election result. In a piece for

Merrill Lynch on ‘How Presidential elections affect the markets’, George L Perry, a Senior Fellow in Economic Studies at the Brookings Institution, said: “For most investors, the best way to prepare for possible market volatility in 2016 is to take a long-term perspective. That means staying focused on your personal goals and on broader economic trends reshaping US and global markets.”

Those broader economic trends include the digital era, big data, cloud computing and cyber security, the article says. It also cites the opportunity presented by baby boomers – with wealth equivalent to a $15tn economy – as they generate demand for everything from leisure to healthcare to hospitality.

“These underpinnings of the US economy are not going to change,” said Mary Ann Bartels, Chief Investment Officer of Portfolio Solutions at Bank of America Merrill Lynch's Investment Management and Guidance division.

Merrill Lynch article

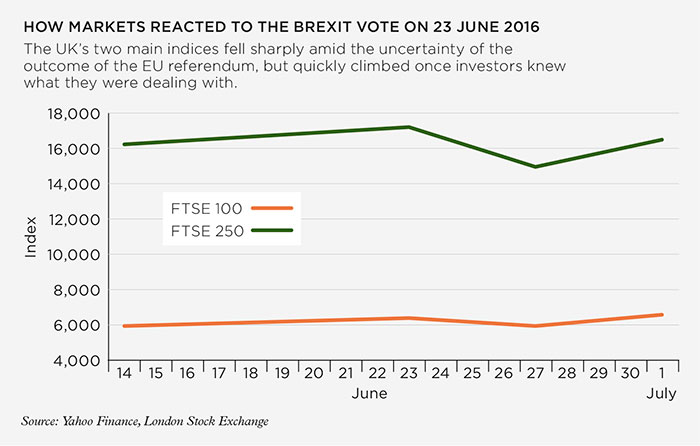

Adept at adaptingOne final thought. Financial markets are efficient at adapting to the unexpected outcomes politicians present them with, as was the case in June when markets dipped after the Brexit vote but quickly recovered. Writing ahead of the UK’s 2015 general election, which delivered the Conservative Party an unexpected majority, our very own columnist

Anthony Hilton reminded us of a period in UK politics where the markets flourished against the odds.

Between 1974 and 1979, a minority Labour government held power. During that period, Britain had to be bailed out by the International Monetary Fund and lived through a period of austerity. Growth was slow and company bankruptcies rose. Despite that, the City innovated, creating the Eurobond markets, financing the development of North Sea oil and inventing financial futures.

“It was not a great time to be a financier, but it was manageable,” Hilton wrote. “People adapted then, just as they will again if they have to do so this year.” The same could be said for life under a Trump presidency.

The Review article

Seen a blog, news story or discussion online that you think might interest CISI members? Email jules.gray@wardour.co.uk.