The Financial Conduct Authority (FCA)

describes the difference between CF30 regulated client facing advisers in two main ways. Financial planners are those who traditionally work on a transactional basis, using suitable investment products to fill gaps to help clients achieve their stated objectives. Cash flow modelling goes hand in hand with this process. As far as the regulator is concerned, suitability of the investment for any given client is at the point that the advice is given for that product, and thereafter when a review takes place.

However, there are other CF30 client facing advisers who offer a discretionary management service, where the client signs an agreement allowing the adviser to manage and change the investments on an ongoing basis, without having to seek permission each time from the client. In the past we may have termed the former as financial advisers or financial planners and the latter as wealth managers. However, the lines are blurring as financial planners and wealth managers compete in the same space, giving comprehensive financial planning/cash flow analysis advice to clients as their main service, into which the investment selection vehicles then feed to ensure the client’s objectives are met as they arise.

HistoryAssessing a client’s attitude to risk has developed over the past 30 years, starting in the early 1980s with a rough-and-ready questionnaire that resulted in, by general agreement, a hit-or-miss scoring system which advisers then used to set overall asset allocation percentages of cash, fixed interest and equities. Product wrappers were then assessed for tax advantages and suitable investments made. A widespread understanding developed that it was the returns from the underlying asset classes that drove the returns that clients achieved, thereby, hopefully, meeting their objectives. By the late 1980s a bigger element of risk tolerance was included in questions that clients were asked.

2 of 13

How many risk profiling tools were deemed adequate by the FCA in 2010

Then from the mid-1990s, the introduction of stochastic modelling, where computer software was designed to produce a range of probabilities of an investment return being achieved, was used to try to predict future investment returns, which ushered a modicum of science into the process. It was then up to the advisers to explain these ranges and make suitable investment recommendations to their clients. Soon after, psychometric questionnaires started to develop. These were based on carefully constructed risk questions that each client answered individually. Finally, from the early years of the millennium, discussions with clients included capacity for loss, eg, how well they slept at night if markets suddenly fell overnight, even if the money wasn’t needed for years. This was evaluated through stress-testing, with the use of cash flow modelling being done on spreadsheets and specialist software. The cashflows were designed to show the inflows and outflows of money over the clients’ entire lifetime. These discussions about capacity for loss, coupled with psychometric questions, became two important developments in financial planning advice in the UK.

David Hazelton, Head of Business Development at wealth manager Raymond James, says that things have progressed over the past 15 years. “If I go back maybe 15 years, I started working with a company called Selestia [now part of Old Mutual] who were the first platform providers to talk about asset allocated portfolios and measuring clients’ attitude to risk. They were building portfolios that were adjusted to the level of risk that clients were required and were prepared to accept.

“At Selestia, we prepared a reasonably thorough questionnaire, but in today’s terms it probably wasn’t very sophisticated. At that stage, nobody really was asking very much about people’s attitude to risk. There would generally be a discussion about their objectives and then somebody would give them an investment solution. There wasn’t really a lot of focus on whether that was entirely appropriate to their needs and their risk.”

"Nobody was really asking very much about people's attitude to risk"In 2010, the FCA investigated the 13 types of risk profiling tools that were available at the time. Only two were deemed adequate. The message was that, if a firm was going to rely on a tool, it had to meet four criteria. First, it must be fit for purpose. Second, it should only be used in the circumstances for which it was designed. Third, its users must understand how it works. And finally, the client must know what is happening and be comfortable with the process.

One of those tools which was deemed satisfactory was produced by FinaMetrica, a specialist in risk tolerance toolkits. The FinaMetrica toolkit is used by many financial planners and an increasing number of wealth managers. The initial research from 2010 was targeted at financial planners and advisers rather than wealth management firms, and so it was only in 2015 that the regulator turned its attention to those firms, alongside private banks.

As Paul Resnik, Co-Founder of FinaMetrica, points out: “Advisers and clients share a common interest; neither one wants the relationship to end unhappily.” And, as Resnik acknowledges, it’s the mismanagement of risk that is the most likely cause of a relationship that ends in tears or legal action.

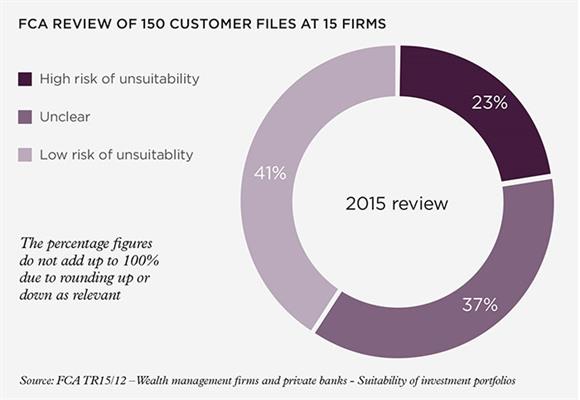

In December 2015 the FCA published a report called

Wealth management firms and private banks: suitability of investment portfolios which looked at how well the UK wealth management industry was assessing client risk and consequential suitability of advice. The report highlighted a number of areas where improvements could be made, with broadly a third of firms falling “substantially short” of the regulator’s expected standards.

Having reviewed 150 customer files from 15 firms as part of its 2015 review, the FCA found that 34 (23%) indicated a high risk of unsuitability, 55 (37%) were unclear, and 61 (41%) showed a low risk of unsuitability.

The FCA’s director of policy, David Geale, underlined in a speech late last year that the regulator had identified “

poor risk profiling or mapping” as one of three main areas in the flawed design of some investment portfolios. The others were: inadequate consideration of costs and inadequate due diligence on products and services. We are seeing the FCA discuss what it believes good due diligence looks like at its roadshows around the country at the moment.

The processAs financial planners point out, there are three quite distinct elements in the client education and advice process when establishing risk. There should be a comprehensive and detailed process which should examine the client’s history with investments and how he or she perceives risk within the investment space. But it should begin with a psychometric-based questionnaire, suggests Nick Grogan, paraplanner with PWS Financial Consulting: “[The questionnaire] should represent a starting point for a wider conversation with the client surrounding risk.”

As Grogan adds, it boils down to a three-pillared approach: “How much risk clients need to take (a financial fact), how much risk they are willing to take, (a psychological trait), and finally how much risk they can afford to take (another financial fact).”

Wealth managers are also changing. “The way in which advisers and clients use risk profiling tools has changed,” explains Andy Cumming, Head of Advice at Close Brothers Asset Management. “Outcomes have become easier to illustrate.”

“We put a slightly different twist on matters,” he adds. “Standard risk profiling takes you through a series of psychometric questions and then bespoke discussions to establish an attitude to risk, which is then used to influence the choice of investment.” Close Brothers uses a modelling tool that incorporates these aspects, but also shows the client a range of potential outcomes that would be expected to result from the various risk-profiled investments. It makes risk-related adjustments; different trajectories, to the portfolio as clients age and their appetite for risk changes.

“Advisers and clients share a common interest; neither one wants the relationship to end unhappily”An important benefit of this approach is a client who is in the loop, which is what the FCA says it wants. “As we can show clients both the upside and downside of taking more or less risk, they can have a much more informed conversation with the adviser [that is] not just about how they feel ‘emotionally’ about risk, but also about how the potential outcomes influence their willingness to take risk,” says Cumming.

Mark MacLean, Director at Cantab Asset Management, says: “We take the results of the analysis [from a psychometric questionnaire] and compare it against the client’s expected score, as this can help with assessing the client’s subconscious and conscious understanding of risk. We also consider the individual answers provided, to check for any inconsistencies or outlying answers, which are discussed with the client.”

A client’s previous experiences and understanding of the investments they have held is then discussed. Having used a psychometric risk profiling tool and discussed the client’s investment experiences, Cantab determines whether the risk and return strategy is realistic, or if it has gone against the client’s individual lifetime objectives.

Hazelton agrees that the psychometric tools are certainly useful, but don’t “look at the whole picture”. Sometimes they don’t “take into account the client’s objectives and what they are trying to achieve”. He gives the example of a naturally cautious investor who has a quite ambitious return target. “To achieve that target, they would actually need to take more risk in order to achieve their goals.”

Another system, Dynamic Planner, is based on the six-stage financial planning process. It starts with a review of the client’s existing portfolio and goes on to an assessment of a client’s attitude to risk. A check is made to establish any inconsistencies in the answers. The client is then assessed for capacity for risk. In the final two steps, the adviser confirms the value at risk and matches the resulting portfolio against defined goals.

Moving partsPsychometric risk profiling tools aim to reflect the inevitable fluidity involved in the design of portfolios. A

paper issued by FinaMetrica explains: “In a comprehensive advice scenario there are ‘moving parts’ to be considered.” In this environment, good practice first requires the adviser to elicit information about the client’s objectives. Each objective should in turn be quantified, have a set time horizon and prioritised. It is good practice for an adviser to obtain full details of the client’s current and anticipated income and expenses, plus current and anticipated assets and liabilities as part of a comprehensive advice scenario. A lot of other numbers, some of them based on future assumptions, should be used within the spreadsheets or cash flow modelling software to comprehensively analyse a client’s situation.

"It is good practice for an adviser to obtain full details of the client’s current and anticipated income and expenses"Assumptions, however, need to be realistic. Being optimistic with investment returns may mean in reality that a client would run out of money in retirement. However, being too cautious may mean that a client will need to invest much more to achieve their goals and run a risk of dying with large amounts of assets. The challenge for financial planners and wealth managers alike is to apply the various tools effectively in a way that gives suitable advice to clients that satisfies the regulations. And this is a process that involves insights and judgments as well as numbers-based decisions. In short, it can’t all be done by the book.

The futureUnder MiFID II, firms will be required to focus on suitability further, with the potential that non-complex products may expand in number, depending on the appropriateness test, and increases in pre-sale cost disclosure. But the biggest impact is likely to be the personalised post-sale disclosure of the actual costs incurred by any given client, which will increase the focus on risk, costs and suitability of recommendations. The Tax Incentivised Savings Association, Wealth Management Association, Association of Investment Companies and others are working with the European Securities and Markets Authority to clarify the areas of concern.

But how will the introduction of MiFID II influence the direction of assessment of client risk? Not favourably, according to FinaMetrica’s Resnik. “Unfortunately, regulatory standards around the world, such as MiFID II, leave a lot to be desired when it comes to offering guidance on how to effectually evaluate an individual’s risk tolerance,” he says. “This is disappointing for investors as research shows they are likely to receive lower returns than the market if risk tolerance is poorly assessed.”

Hazelton says that maybe the wealth management sector was “a bit slower to genuinely understand the client’s attitude to risk”. He adds: “Their approach has been typically to describe the portfolios that they run, often in language that clients don’t understand, and ask them which they think is most appropriate. Typically this may be an equity based portfolio that may not be appropriate for all clients.”

However, he adds that the wealth management industry has “really upped its game” recently. “I think it’s true in the past the wealth management industry has lagged behind, but I think now they’re probably at a good place in terms of the way they assess attitudes to risk.”

"Advisers really need to understand the products they are recommending"The FCA is currently working on a thematic project that seeks to understand where the industry stands on due diligence. In this, specific firms are being measured against current suitability rules. “Firms will be required to have policies and procedures in place to ensure they understand the nature and features of the products they select for their clients,” warns the FCA’s Geale. “This is a clear signal that advisers really need to understand the products they are recommending.” MiFID II may also impact in this area.

While there are still some uncertainties for what is to come, what is evident is that assessing suitable investments starts first with an in-depth analysis to develop an understanding of the client’s attitude to, capacity for and tolerance of risk.

Part of that understanding clearly depends on the effectiveness of the client risk profiling and questioning process, of which psychometric tools are just a part. While it appears that progress is being made by wealth managers and financial planners, it is evident that the FCA will be watching intently to see that risk profiling standards are both improved and maintained.

The original version of this article was published in the July 2016 print edition of The Review.