UK banks have had a torrid time since the dawn of the financial crisis back in 2008. Rightly so given their, some would argue, pivotal role in tipping the country into one of the steepest recessions in generations.

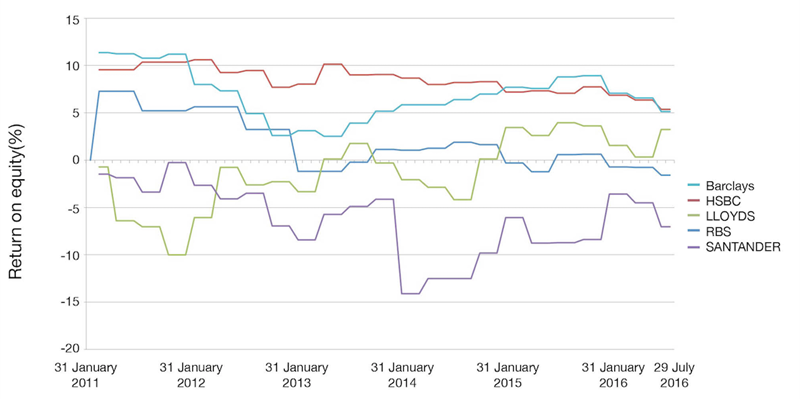

Return on equity (RoE) has not hit double digits for UK banks since 2007, according to EY’s

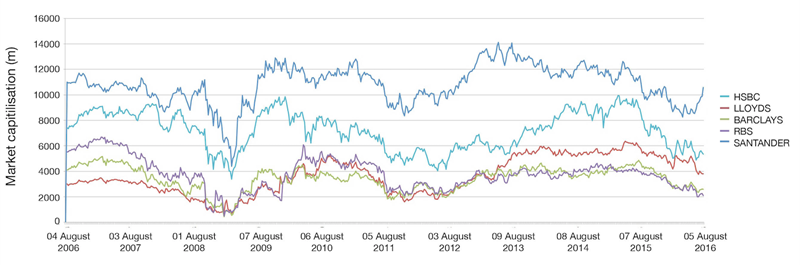

European banking barometer – 2015. Back then, UK banks averaged 17.6%, but that soon dropped to 9.4% in 2009 and then 1.1% in 2013. Research by Thomson Reuters Datastream also shows that European banking stocks are trading at less than 40% of their August 2007 values.

HSBC has been penalised by US regulators for money laundering, with other UK banks having to pay billions of pounds in compensation to customers for misselling debacles, such as payment protection insurance and interest rate swaps. Bad loans, such as those in commercial property real estate, have also battered capital reserves and profits.

And banks, such as the Royal Bank of Scotland and Lloyds Banking Group, have been further hit by volatile economic conditions. Business and consumer confidence levels have see-sawed, with the resulting effect on demand for credit hitting bank income.

The historic low interest rate of 0.5%, which had been in place since 2009, but which was recently cut further as part of a move to boost the ailing post-Brexit economy to 0.25%, has also hit revenues, with investors and savers tending to look for alternative routes to make a return. In addition, lower loan rates also dampen profits. Banks make their money on the spread or difference between the rate of interest savers receive and the rate they charge borrowers. This spread has declined in recent years as loans have become cheaper but interest rates have stayed frozen.

Following the referendum decision to leave the EU, there is also a strong possibility that interest rates might fall even further, perhaps even into negative territory, as the Bank of England (BoE) tries to prevent Brexit nervousness from damaging the economy.

But an impact is certain to be felt whatever the BoE chooses to do. In a recent note, Antonio Garcia Pascual, a Barclays analyst, said lenders could see a squeeze in net interest margins, increased funding costs and a rise in loan defaults.

Banks are also having to prepare themselves for more major regulatory change.

Stress testsBanks already have to face stress tests where their Tier 1 capital ratios – the comparison between a firm’s core equity capital and total risk-weighted assets – are used to judge financial health.

From 2019, alongside the ring-fencing regime that aims to formally separate UK banks’ retail arms from their riskier investment banking divisions, will come a new systemic risk buffer (SRB).

The amount of capital banks will be required to hold will vary in size depending on the operation’s level of risk. It is expected, however, that the SRB will be set at 0% for banks with assets below £175bn and increase gradually to 3% of risk-weighted assets for companies with over £775bn in assets.

The Basel Committee on Banking Supervision is also lining up a fundamental review of the trading book regulation and the Standardised Measurement Approach (SMA) for operational risks which aims to standardise the calculation of operational risk capital among large international banks.

3%

The systemic risk buffer for banks with assets over £775bn

Essentially, this will prevent banks from continuing to use their own models to calculate risks, such as system failures. Instead it will standardise the assessment of these risks. Again, this is likely to push some pressure on capital requirements for banks if they are deemed to be riskier than they were previously. On the other hand, those seen as less risky will likely have maintained or lower capital requirements.

Where then does this combination of economic turbulence, legacy payments and regulation leave a bank’s basic fundamentals of posting a profit and achieving a strong RoE? How can they best face the future?

“The profits that banks generate are going on the balance sheet to meet Tier 1 capital ratios. They are not very scientific,” says Eric Moore, Investment Manager at Miton Group. Initially, the ratio was 10%, but that has since increased to 13%. “That drags down RoE and profits. Lloyds, for example, is a straightforward model. It does things you understand, such as current accounts and mortgages, and has share and economies of scale in these activities which are very profitable. But the money has gone out in fines, compensation or onto the balance sheet.”

Moore says increased capital requirements means two responses from banks – either to shrink or put their prices up. “Neither of those are good for the economy,” he states. Another consequence of these increased requirements is banks reducing shareholder dividends.

Separation of powersThe banks have reacted by separating their balance sheets into core and non-core, which Moore defines as “those activities they wished they had never got involved in, and those that require so much capital to be held that RoE would be battered”.

Barclays recently reported non-core losses of £2bn in its first six months. Its non-core includes its African business, closing investment bank operations in nine countries, cutting thousands of jobs and divesting £50bn of risk-weighted assets.

“The rest of the bank is actually quite profitable. The UK high street bank is doing well, Barclaycard has a growing business and an investment bank which is washing its face,” Moore says. “Perhaps it is a bit of a Jedi mind trick in trying to get investors and the public to focus on what we are going to be rather than what we are now. But in the real world, Barclays and RBS have nasty habits of sliding more bad news into the arena. The non-core never goes away.”

Lloyds has recently taken its own action, closing hundreds of branches and cutting thousands of jobs. “The banks need to make these cost-cuts because the UK is significantly over-branched. The footfall is down 20% year on year. You need to get out of property as quickly as you can,” Moore says. “It is politically difficult, but this is just the beginning.”

What is harder to rectify, though, is RoE. “Lending spreads were better before the crunch,” Moore says. “Leverage has also been reduced. You have to hold more equity, so for every pound of profit you make the RoE is lower. It will never go back to 25%, not in my lifetime. Lloyds’ underlying RoE is 14% but the statutory, which includes the bad stuff, is 8%. Around 15% in the future will be a good result.”

Pauline Lambert, Executive Director of Financial Institutions at Scope Ratings, says if you concentrate on UK banks’ core and underlying operations they are still generating RoE in the low double-digits.

“However, reported statutory returns are much lower,” she says. “The difference is due to conduct and litigation costs, such as PPI claims and restructuring costs. Until the banks work through these issues it is unrealistic to expect higher reported returns.”

She believes banks can achieve low double-digit returns as they resolve legacy issues, wind down non-core businesses and adapt to new market realities. “We won’t get back to those levels of 25% we saw in the past,” she says. “The business environment has changed. With interest rates as low as they are and Brexit potentially hitting volumes, it is not possible for banks to earn as much as they once did. As well there is increased competition from new players, notably fintechs.”

The level of capital banks now need to maintain also make it unrealistic to return to the previous highs. “However, UK regulators appear to have reached a point where they are generally comfortable with the banks’ capital positions and I would not expect them to increase going forward. In fact, there is currently a slight softening of requirements as we recently saw with the postponement of the 1% countercyclical buffer.”

Diminished returns Global investment banks have also seen declines in their RoE. According to recent research by business intelligence provider Coalition, the world’s top 12 investment banks, including J.P. Morgan and Citigroup, recorded an RoE of 9.2% in 2015, down from 10.5% in 2013. That is below both the cost of capital of around 10% and the mid-teen returns which investors hope to see. It echoed comments from BoE deputy governor Jon Cunliffe earlier this year, which cautioned that there was a wide gap between banks’ “disappointing returns” and investor expectations. “RoE in the investment banking parts of UK banks is around 5%. It was 20% in 2010,” he says. “Parts of investment banking are therefore not economically profitable.”

"There has been a continual disappointment about these banks’ ability to pay normal dividends again. But our banking sector is a concentrated market with large market shares, so banks will always find a way of getting to profitability in their core activities"

Investment banks have been hit by a wave of regulation since the financial crisis in 2008. This includes bans on proprietary trading in the US under the Volcker Rule, with similar sanctions being considered by the EU as part of its Regulation on Bank Structure, or using bank capital to make market bets. Certain assets such as mortgage portfolios or small and medium-sized enterprises loans deemed risky to the health of the retail arm, have also been moved into non-core divisions of leading banks or sold on.

They are also susceptible to some of the economic hits UK high street banks have taken, such as slowing growth, volatile commodity and currency prices and low interest rates.

Serge De Coster, Head of Capital Analytics at Coalition, expects pressure on investment banks and their capital to continue to rise as a result of upcoming regulations. He highlights the Basel fundamental review of the trading book regulation and the SMA for operational risks. “Both will significantly affect RoE in negative terms as more capital is required.”

He says profits are already “really challenged” in the investment banking sector. “It is a declining industry in the sense that total revenues of the Coalition Index have reduced by 15% across equities, fixed income, currencies, and commodities, and investment banking divisions since 2010,” he says.

“Banks have taken two approaches to this challenge. One has been to reduce the overall size of their investment banking business and focus on capital efficient activities. However, this results in a lack of scale and a high cost-to-income ratio. The other approach is to continue to commit balance sheet and capital to clients and generate higher results through a full-service business model.”

Moore says investors looking to bank shares have a tricky decision to make. “Do you think long-term and see a better future for a group like Barclays? And are you looking for firms to generate a good dividend?” he says. “There has been a continual disappointment about these banks’ ability to pay normal dividends again. But our banking sector is a concentrated market with large market shares, so banks will always find a way of getting to profitability in their core activities.”

Banks are working through their legacy issues. Sometimes it is difficult to see the progress they are making when non-core divisions drag down both overall profitability and RoE. But in most cases the core activities of retail banks are still profitable. They are lending, improving customer service and taking strong measures to improve cost efficiencies.

RoE will steadily improve as non-core divisions are wound down and finally cleared. But to expect a return to the glory days of 25% returns is whistling in the wind. The banking world has fundamentally changed with low interest rates, increased regulation and tougher competition.

Bank chiefs know they are in the firing line of consumers, the press, Government and regulators. What is needed now is a period of stability to restore credibility, profitability and returns.