1. Planning for Brexit

Much has been said about the possible impact of access to EU customers and counterparties by UK firms in different sectors. The three main scenarios are (a) continuity of full reciprocal access by agreement – currently thought unlikely; (b) more limited access based on the Swiss model, varying between individual financial sectors; and (c) basic World Trade Organization non-discriminatory access – which is more weighted towards goods than services (under which the UK would be a third country under EU rules for equivalence purposes). There are other ideas too, such as an alliance with Switzerland – and possibly some Nordic and Eastern European countries – on joint negotiations with the EU on financial services.

Since negotiations with either the Commission or EU governments are unlikely to start until 2017, little reliable information on these models will be available until then. There is also the uncertainty of whether existing and new EU nationals can work in the UK (on estimate is that they make up 11% of the estimated 360,000 City workers) – quite apart from the psychological message that they are not welcome. So all firms need to develop contingency plans for the worst case – while hoping for the best.

The danger is that these plans will develop momentum in an information vacuum, and that new activities will be set up in the EU or – worse for London – that existing activities and staff will be transferred to show that a new EU base is real and not artificial. The only certainty is that the UK will not leave the EU before 2019.

The FCA has told firms that it is business as usual, including preparing for the start of MiFID II in January 2018, but it has asked many firms individually what their Brexit preparation plans are, and whether they will relocate some or all of their business to the EU. Firms will be affected differently under each of these three scenarios depending on their sector, products, group structure and customers.

Some firms with EU customers already have companies elsewhere in the EU (eg, asset managers in Luxembourg or Ireland), and others plan to establish them to serve EU customers. Smaller firms may stop doing EU business, eg, advising EU expats.

More widely, the financial services trade bodies, TheCityUK, the European Financial Services Chairman’s Advisory Committee and the Financial Services Negotiation Forum have all set up working groups to consider specific Brexit issues, and to pass these to the Treasury which is centering the financial services Brexit position for EU negotiations.

Firms have the opportunity to make their individual concerns known to the Treasury directly or through these groups. These concerns include plans for the transition between the current and future regime, since the two years exit notice under Article 50 may be too short in practice.

Much of the Brexit impact is clear, but some points are less obvious, such as:

- the need for new access and data protection agreements with non-EU countries, since the EU ones will no longer apply (the US has already warned on this)

- access to EU payment and clearing systems and to markets

- there may be perception from customers that UK firms are at a disadvantage to EU-based competitors for EU investments

- the possible hostile attitude of individual EU countries (for example in grey regulatory areas, such as firms doing business with professional counterparties without a formal passport)

- the impact on UK bank ring-fencing of the disapplication of EEA deposits in bank capital

- the extra regulatory capital needed by UK branches of EU banks (one estimate is €40bn)

- possibly paying for visas for EU staff, not being part of the Capital Markets Union (see the Commission’s July statement on progress on this)

- the difficulties in influencing the making or reviewing of new EU laws appropriate for wholesale markets and non-bank distribution

- lack of access to important market, transaction, price and credit data

- future policy decisions by the ECB on banks as the eurozone integrates

- possible relaxation of UK supervision to make the UK more attractive.

2. What are the regulators’ views of conduct risk?

The PRA and the FCA joined relevant firms (mainly banks) in making intensive preparations for the start of the Senior Managers and Certification Regime (SMCR) in March this year. Apart from firms developing the practical aspects, such as in handover certificates and changing hiring procedures, there are important questions on how the regulators will monitor firms’ progress and how the SMCR relates to conduct risk.

The starting point in answering these two questions is the priority given to the conduct of firms and individuals. The Chairman of the FCA (John Griffith-Jones) believes that conduct will be very important. He believes that conduct in the wholesale markets cannot be kept separate from that in the retail markets, and that the SMCR and conduct risk initiatives have not yet affected the public’s view that nothing much has changed in the world of finance (an example is the book

Swimming with sharks: my journey into the world of the bankers by Joris Luyendijk). Therefore, changing culture is a key priority.

However, supervisors’ approach appears to have changed. For bankers the conduct principles under the SMCR overlap with and largely crystallise the regulators’ expectations of firms and individuals – removing the focus on a separate conduct risk policy and programme. For non-banks, particularly both sell-side and buy-side wholesale firms, conduct risk remains important until the SMCR starts to apply to them – planned for 2018. But there is a subtle shift here – many regulatory staff have been trained in the application of the SMCR – and will see conduct risk from that viewpoint. The concept of a corporate responsibilities map and of individual role descriptions under it will be at the back of supervisors’ minds when considering how firms answer previous Acting CEO of the FCA Tracey McDermott’s

five questions.

These answers apply equally to retail advisors. The FCA’s head of retail (Jonathan Davidson) recently said that the SMCR was an important part of how the FCA influences good culture. (He also said that while proportionality to the size of the firm is key, the FCA will expect all firms to demonstrate clarity, accountability and transparency of senior managers:

“Our expectations around conduct, whether the firm is large or small, remain high”). Firms should note this and consider how they will introduce the SMCR.

The next milestone (October) for implementing the SMCR is the first annual date for notifying the regulators of individuals’ breaches. Firms’ policies may vary widely between listing everything to only larger ones.

3. The MiFID II and PRIIPS challenge for providers and advisers

One important part of MiFID II requires product providers both to design their products for a particular segment of the retail market, eg, age or region or income, and to check that the distributors have achieved this. Distributors must provide information to providers for them to do so. The practical problem is that distributors may not have the relevant information, particularly execution-only platforms. After lengthy negotiations, the amount of data requested by providers has been heavily reduced. Distributors are also reluctant to provide the information in case providers who sell direct misuse the data, so a neutral third party is needed.

The related packaged retail investment and insurance-based investment products (PRIIPs) regulation causes particular concern to both providers and distributors. The European Parliament has stopped the implementation of PRIIPS (and the Key Information Document (KID) under it which tells investors about products in a consistent manner) on its planned start date in 2017. There will now be further negotiations with the industry.

More generally on firms’ preparations for MiFID II, the FCA has encouraged firms to continue despite the referendum, and it continues to be active on MiFID II in Europe (particularly on the conduct of business rules). Firms hoped to have more time to prepare for the start of MiFID II after its postponement until January 2018. Sadly, the European Securities and Markets Authority (ESMA) has made limited progress in finalising the difficult outstanding detailed rules, such as on bond pre-trade price transparency and product costs and charges disclosures, so firms will only have a short time to prepare for these new rules, assuming a 2018 start date. The FCA has equally seen its hopes for making its final rules and guidance based upon ESMA’s standards and guidance delayed for these and other reasons.

However, firms need to plan for the big changes to markets, dealing and asset management under it on the basis of the existing MiFID II Directive and regulation and ESMA standards and guidelines.

4. What should the FCA do about fund ‘gates’?

The recent series of property funds imposing ‘gates’ on investors from selling, highlights the liquidity weakness of some retail fund products in the length of time it takes to sell the underlying assets. Commentators have urged a variety of approaches – from ensuring that such funds operate in a way that is transparent to investors (and their advisers) on purchase and is fair to both redeeming and continuing investors (where early sellers may receive more than remaining ones), to restricting their sale to retail customers altogether as too risky, and even to fund managers having a duty to inject liquidity into the funds. Andrew Bailey, Chief Executive of the FCA, said: “The FCA will continue to liaise with the funds as they keep the situation under review."

Property funds are only one example of retail funds that buy potentially illiquid assets but offer daily sales opportunities – exchange-traded funds (ETFs) being the prime example, particularly bond ones. If there is a mass exit from fixed income investments for any reason, liquidity could quickly disappear – with the same problems as for property funds – but on a much larger scale.

The regulators have not extended their review to bond ETFs, but may do so as a systemic risk. (This places the government in an awkward position in selling its gilts.) Multi asset products are another example – indirectly through their investments in gated property funds.

5. Competition and the asset management IndustryWe now have a clearer picture of the regulators’ use of their recently acquired competition powers in financial services. The FCA’s head of competition (Mary Starks) made the important point that the FCA will now add a markets based view to its supervision of individual firms, which brings in both consumers’ and innovative entrants’ perspectives. She appreciates that introducing more competition into markets or sectors will disadvantage some existing firms – possibly leading to them to leave – reducing competition.

Another challenge is to ensure that the distribution of benefits of competition are fair and reach the targets for which they are intended. Note also the Competition and Market Authority’s apparently tougher line on mergers, including in financial services.

A good example of the FCA’s approach can be seen in the current competition study in the asset management sector, specifically on how fund providers deliver value and how willing they are to control costs along the value chain – given its many intermediaries who together receive 2.56% of portfolio value annually, according to a recent study by Grant Thornton. To start with, the FCA has sent firms wide data requests, described by one adviser as “onerous. It is a large amount of data in a short period of time. It is ambitious for firms to provide it in this amount of time and for the FCA to absorb it.” (In fact the FCA has recently said that due to the volume of data, it will delay its preliminary report from this year until 2017.)

6. The regulators focus on firms’ liquidityIn the past the focus was on firms’ capital adequacy. The 2008 crisis exposed the weakness of the Basel requirements for banks’ liquidity. That was addressed by Basel III and the EU Capital Requirements Directive and the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) requirements, as well as strengthened capital adequacy rules. What is new is the UK regulators’ focus on non-banks’ liquidity, including in stress scenarios. This is in part driven by the EU adopting a new framework for regulators’ supervisory regulatory evaluation process. The FCA has indicated that it will apply the new procedure beyond banks to Capital Requirements Directive IV (CRD IV) market makers, broker/dealers, investment managers, and to non-CRD advisers, arrangers and commodities brokers. This has already resulted in increasing the FCA prudential category of some firms.

Some investment management firms have already experienced the FCA’s more active calling in for review of their ICAAP and ILAA documents, with capital add-ons under Pillar 2 – in some cases reported to be twice their current capital. The better news is that insurance and diversification can be used in part in place of capital to meet the requirements – otherwise it is retention of profits and cutting dividends.

Firms should be prepared to answer questions on their ICAAP and ILAA, and perhaps to increase their capital.

7. Have you reviewed your whistleblowing procedures?From September 2016, new rules will apply to banks and PRA designated investment firms on whistleblowing procedures. Those firms have already appointed a whistleblowing champion under the SMCR, who will be responsible for overseeing the steps the firm takes to prepare for the new regime. The steps are:

- Appoint a senior manager as the whistleblowers’ champion.

- Put in place internal whistleblowing arrangements able to handle all types of disclosure from all types of person.

- Put text in settlement agreements explaining that employees have a legal right to blow the whistle.

- Tell UK-based employees about the FCA and PRA whistleblowing services.

- Present a report on whistleblowing to the firm’s board at least annually.

- Inform the FCA if the firm loses an employment tribunal with a whistleblower.

- Require the firm’s appointed representatives and tied agents to tell their UK-based employees about the FCA whistleblowing service.

Once the new rules have been in effect long enough to assess their effectiveness, the FCA will consider whether to apply similar requirements more widely, such as to stockbrokers, mortgage brokers, insurance brokers, investment firms and consumer credit firms. In the meantime it is likely that the FCA will consider it good practice for these other firms to review their current procedures against the new requirements. The CISI has given interactive training sessions to the staff of many firms on

‘Speak up’ as part of their preparations.

The FCA itself has been taken to task by the Complaints Commissioner for its internal procedures in dealing with whistleblowers to it, particularly in its categorisation of them as ‘non-routine’ when they apply for an Approved Person role at another firm. The FCA has reviewed these procedures, and has published an explanation of them (

‘How we handle disclosures from whistleblowers’, which describes the work of the specialist unit set up to respond to these). The regulator has also been questioned on its use of information from a small business lobby group which it did not treat as a whistleblower because the whistleblowers had already disclosed their identities to their employers – so confidentiality did not apply.

8. What are the latest enforcement trends?

Here are some headline developments:

- The FCA’s detailed description of its expectations on compliance officers to prevent misleading promotions, and to stop the marketing of products that fail to reach their target audience (Peter Francis Johnson of Keydata).

- The FCA’s expectation that an alternative investment market nominated adviser (AIM Nomad) or main market sponsor should challenge statements and forecasts made by issuers in public documents (Quindell/Cenkos).

- The substantial payment made by State Street in the US for adding mark-ups to charges to pension funds for dealing in foreign currencies without disclosure.

- The criticism by some MPs of the FSA and the FCA in their handling of their HBOS investigations, leading to calls for the enforcement division to become independent from the FCA’s other divisions (as the Crown Prosecution Service is from the Police) because of perceived conflicts of interest.

- The Inquiry by the Treasury Select Committee into whether the PRA should publish “information … consists both of material that banks provide to supervisors … and of instructions, directions and advice that supervisors issue to individual banks … Shareholders, holders of debt securities and depositors do not have access”. Under current law the regulators cannot publish confidential information from or about firms except under limited gateways. However, some commentators argue that it could publish information in summary form without a law change.

- The strong recommendation by the Complaints Commissioner, Andrew Townsend: “While the FCA continues to deal with the majority of complaints competently and fairly, I have seen examples of an unwillingness to face up to and to admit shortcomings, and delays in awkward cases.” The number of formal complaints has increased recently.

- The latest survey of leaks before UK public takeovers were announced shows that the share price rose unusually in 13% or 20% of the events. This is below the 2009 figure but more than in 2014.

- More problems for the FCA in identifying individuals by implication in final disciplinary notices issued to others without giving them the chance to comment first (Julien Grout). Another such case is going to the Supreme Court (Macris).

- An individual fined £110,000 for presenting a false Statement of Professionalism under the RDR.

9. In brief

- The regulators’ policy of relating employee bonuses to performance has finally gained some traction with firms, not only with salary increases and lower bonuses, but also with some firms dropping bonuses altogether in favour of larger salaries and stock options.

- The lengthening time for the FCA to process new firm authorisations. Now six (retail applications) to 18 months (more complex ones), and forecast to take longer. However, the time taken for variations of permission for existing firms has marginally improved from 19 to 15 weeks, except for complex ones which have increased from 38 to 44 weeks – compliance departments please note.

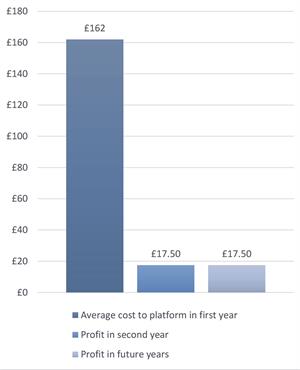

Robo-advice costs and profit

- The encouragement of robo-advice by the FCA’s launch of a separate unit (Advice Unit) to help firms which deliver fully or partly automated advice at lower cost to “unserved or underserved” retail customers. This covers both existing and new firms which need to apply to be selected for help (first quota full; watch out for future invitations). A report from IRN Consultants suggests that pure robo-advice firms may struggle economically – average cost to platform in first year £162 per customer, profit in second and future years £17.50. Others predict explosive growth of such services, like execution-only platforms.

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.

This article was originally published in the September print edition of The Review. The print edition is available to all members who opt in to receive it, except student members. All eligible members who would like to receive future editions in the post should log in to MyCISI, click on My Account/Communications and set their preference to 'Yes'.