1. Andrew Bailey: the new head of the Financial Conduct AuthorityIt should be easy to know the priorities of Andrew Bailey, the newly appointed Chief Executive of the Financial Conduct Authority (FCA), from his past 30 years at the Bank of England and the Prudential Regulation Authority (PRA). It is, however, not that easy, since his experience is more in prudential regulation than conduct of business. What is clear is that he knows a lot about regulating banks and sell-side activities, so he now has a lot to find out about the other sectors that the FCA regulates, such as private wealth management and insurance. He may also find it hard to imagine the dynamics of small firms. The strength of character that he has shown in establishing the PRA may be necessary to set the balance between firms and consumers amid overview by politicians, not only the Treasury but also the Commons Treasury Select Committee (see for example the report on the effectiveness of the FCA Board commissioned by the Committee which found some weaknesses), which may have made the role seemingly unattractive to some rumoured overseas candidates.

Another approach is to see it as a return to a single regulator, given Mr Bailey’s long-term career at the Bank and current role as Deputy Governor there – with all the advantages of co-ordination and disadvantages of conflicting priorities that this produces.

2. EU reform: the financial services section of the Council’s February letterThe wording below is from the February letter from Donald Tusk, President of the European Commission, to David Cameron. To some extent it has been overtaken since it was written by the EU members’ agreement negotiated on 20 February, which is based upon it, but with changes.

"1. Legal acts, including intergovernmental agreements between member states, directly linked to the functioning of the euro area shall respect the internal market or economic, social and territorial cohesion, and shall not constitute a barrier to or discrimination in trade between member states. These acts shall respect the competences, rights and obligations of member states whose currency is not the euro.

2. Member states whose currency is not the euro shall not impede the implementation of legal acts directly linked to the functioning of the euro area and shall refrain from measures which could jeopardise the attainment of the objectives of the economic and monetary union.

3. Union law on the banking union conferring upon the European Central Bank, the Single Resolution Board or Union bodies exercising similar functions, authority over credit institutions is applicable only to credit institutions located in member states whose currency is the euro or in member states that have concluded with the European Central Bank a close co-operation agreement on prudential supervision, in accordance with relevant EU acquis. Substantive Union law, including the single rulebook concerning prudential requirements for credit institutions or other legislative measures to be adopted for the purpose of safeguarding financial stability, may need to be conceived in a more uniform manner when it is to be applied by the European Central Bank in the exercise of its functions of single supervisor, or by the Single Resolution Board or Union bodies exercising similar functions, than when it is to be applied by national authorities of member states that do not take part in the banking union. To this end, different sets of Union rules may have to be adopted in secondary law, thus contributing to financial stability."

3. Where are we on MiFID II?

The ‘MiFID II monster’ is unstoppable. It is delayed until January 2018, since the European Securities and Markets Authority (ESMA), the Commission and the Parliament agree that the original timetable of January 2017 is impracticable, so giving ESMA enough time to make the necessary IT preparations based on its final draft standards, and firms and markets enough time to implement these. Firms could postpone their preparations, but many are proceeding with them, given the time needed for fundamental changes to markets, products and the conduct of business, and the availability of most of the detailed rules in ESMA’s draft final standards. There remain important exceptions, for example in the liquidity of bonds, where ESMA’s Chairman, Steven Maijoor, recently estimated that only a small fraction of the 54,000 bonds currently admitted to trading would meet the test for the mandatory on platform execution requirement, and on the ban on product providers’ payments to distributors.

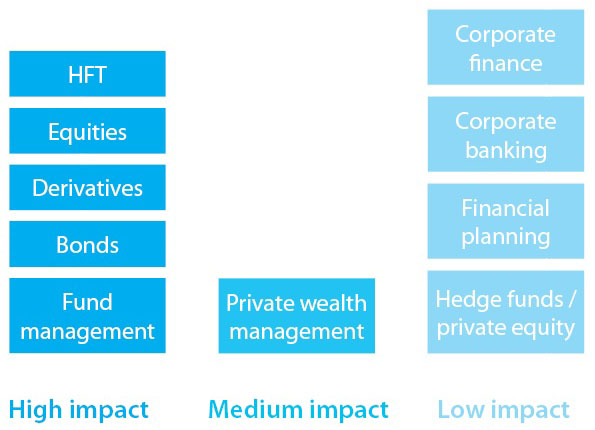

Firms in different financial sectors will be affected differently by MiFID II changes – see graphic above. Sell-side firms will be most affected – through mandatory on platform execution of liquid bonds and derivatives, by the new pre- and post- price transparency disclosures and by the new classification of firms regularly matching customers’ orders with discretion (organised trading facility – OTF) or using their own funds to do so (systematic internaliser – SI), with the consequential duties, eg, OTF price transparency or SI market making.

Although less affected by MiFID II changes, private wealth managers have to make significant changes too, such as in possible changes to the UK product provider’s commission ban under the Retail Distribution Review, and in costs disclosure, best execution, record keeping of electronic communications, client reporting, transaction reporting and product distribution responsibility.

4. The Senior Managers Regime

The one immutable change surviving the recent change in banking supervisors’ attitudes, is individuals’ regulatory responsibilities. The edges of the new regime may have softened, eg, in moving the burden of proof back to the regulator for breaches of regulation in his or her area of responsibility, but the regime is essentially untouched. This has led banks to undertake a huge amount of work in producing the management responsibilities map and the individual statements of responsibility (SoR) and in making the necessary ‘grandfathering’ applications for existing staff. The regime starts in March for senior managers and certification staff in banks, including some large investment banks. In 2018 the new regime (with some modifications) will apply to all types of firms (replacing the current Approved Persons Regime), so they will need to take notice of how the banks are preparing now.

Some difficult issues they have encountered are:

- aligning the responsibilities map with the corporate or group structure

-

in the SoR, balancing group or committee decision making with individual responsibility under the SoR (operating by consensus is one solution

-

establishing which overseas head office staff to include as managers (do they have a power of direction over the firm’s activities?)

-

if decisions are taken at overseas group level but the UK individual is responsible to the regulator, should that person have a right of veto or appeal over the head office’s decisions?

-

whether the firm’s general counsel is a senior manager. The regulators are considering this. Firms are not keen given its likely effect on legal privilege.

5. What is happening with the Fair and Effective Markets Review?

There has been little publicity about progress on the Fair and Effective Markets Review’s (FEMR) recommendations since they were published in June 2015. However, action is being quietly taken on these big changes for all firms in the Fixed Income, Currency and Commodities (FICC) markets.

- The FICC Market Standards Board under its interim leader, Elizabeth Corley, has started work on clarifying the issues (such as ‘last look’ and ‘stop loss’) raised in the FEMR report, and has set up a series of working groups to do so. Many of these issues are now being regarded as generically similar across foreign exchange (FX) and all other FICC products.

- Meanwhile, work continues on the new Code of Conduct for FX – the Bank of England FX Joint Standing Committee, reformed with new Terms of Reference, met on 28 January. Its work focuses on the drafting of the Global Code and the Bank’s role of promoting and incentivising adherence. An interim draft will be published in May 2016. The most active banks and interdealer brokers in the global FX market have recently completed their FX remediation and attestation work for the FCA and PRA, which, it is hoped, will help to draw a line under the issues that have damaged the reputation of the FX market in recent years. Much of the work being done in FX will feature in future arrangements for other FICC asset classes.

- Finally, the FCA has responded to the FEMR recommendation that a modified form of the Senior Managers and Certification Regime (SMCR) should apply to FICC employees, through rolling out the regime to all types of firms both inside and outside FICC from 2018 – see ‘The Senior Managers Regime’ for more information.

6. The Market Abuse Regulation starts soon and will affect you

Overshadowed by MiFID II, the Market Abuse Regulation (MAR) makes big changes to the market abuse regime, which will affect most types of firms (apart from investment research). It starts on 3 July this year, so there is little time to prepare for these. The scope of the regime is widened to cover commodities derivatives, high-frequency trading (HFT), attempted dealing and the new type of trading platform under MiFID II, the organised trading facility (effectively bringing in non-EU listed investments). There are many important new duties on firms as a consequence, such as consistent transaction monitoring (with a bias towards systems), speeding up Suspicious Transaction Reports and market disclosures, changing market sounding and investment recommendation practices, tightening up the regime for managers’ transactions and issuers’ disclosures, and more detailed record keeping and disclosure requirements. The FCA is currently consulting on market soundings and issuer disclosures.

Firms that have not yet started to prepare for these changes should now do so urgently.

7. Do you know how the EU Benchmarking Regulation applies to users?

This Regulation goes much further than the current UK rules, which are on the administrators of a few key indices, such as the London interbank offered rate (LIBOR). It applies to any “index or indicator used to price financial contracts or to measure the performance of an investment fund”, whether the index is EU or non-EU, such as the S&P 500 – the emphasis is on how the index is used. Although most of the new requirements will apply to the submitters and administrators of benchmarks, users – such as funds or even wealth managers – are subject to the new requirement not to use an index or benchmark for which the administrator has not been authorised (if in the EU) or recognised as subject to equivalent regulation if outside it. Procedurally, therefore, it is up to the administrator to apply for this approval or recognition, failing which the fund or portfolio manager cannot use it. This has led to considerable concerns among managers that they will be restricted in their choice of benchmarks, because non-EU administrators may not apply. These apply equally to EU benchmarks – indeed a number of leading providers, such as Barclays and HSBC, have not liked their new onerous duties as administrators, and have either outsourced or sold their benchmarks. This has led to competition concerns as the number of suppliers shrinks and barriers to new ones increase. Regulators have tried to soothe these concerns through requiring providers to give fair access to benchmarks, but many firms worry that they will have to pay high royalties to use those that are available.

The Regulation is likely to be implemented towards the end of 2017, after ESMA has made the detailed level 2 standards. Firms are encouraged to become involved in making these now.

8. Can you ‘buy-out’ a new joiner’s lost bonus shares?

The PRA is consulting on changing the Remuneration Code to restrict a firm’s ability to ‘buy out’ the variable remuneration of a new employee’s deferred bonus award that the old employer has cancelled. The options are: banning buy-outs; requiring firms to maintain unvested awards when employees leave a firm; applying malus to bought-out awards; and relying on the existing clawback rules. The PRA is concerned about the practical difficulties of the first two, and favours the third approach (applying malus to bought out awards). Currently this new rule will only apply to material risk takers in Remuneration Code Tier 1 and 2 firms. In future, under the European Banking Authority’s (EBA) extension of the Code to Tier 3 firms, this restriction will apply to all Code firms.

9. What’s new in supervision and enforcement?

Quite a lot. Here are some highlights:

- Research by the archiving and compliance firm Smarsh into what email and instant messages the FCA expects firms to keep has shown that 69% were asked to show email records, 39% telephone call logs and recordings and 36% instant messages sent to clients or chats via websites. MiFID II will extend both the scope (eg, mobiles) and period (eg, five years) for records.

- There is an important speech by Jamie Symington, Director in Enforcement on internal investigations into problems by firms. This describes when the FCA approves of them as not prejudicing its own enquiries, and what the firm can do to encourage reliance upon those investigations, eg, the degree of independence and discussing the scope with the FCA in advance, and the problem of what documents from the internal investigation to disclose to it and in civil court proceedings brought by customers.

- The FCA has given a useful description of when it will use its restriction and suspension powers for firms’ regulated activities. This is primarily to deter where it is more effective as a disciplinary step. Examples given are preventing a firm appointing Appointed Representatives and from taking on new customers.

- The PRA has begun to use financial penalties as a disciplinary tool. In one case it fined a private bank for failing to oversee a key outsourcer through giving it authority to move customers’ funds; in another case an individual firm owner for diverting insurance premiums leaving the insured without cover.

- The saga of complaints about the FCA including reasons in final notices agreed with the firm that indirectly identify a person, which that person has no opportunity to contest, continues. The Upper Tribunal test is whether the person is able to satisfy it that any of the words would reasonably lead persons acquainted with the person, who operates in that financial services industry sector, to believe that he is prejudicially affected by those notices. Decisions have gone both ways.

10. Many financial crime developments

- The Fourth Money Laundering Directive (MLD4) is coming. All countries, including the UK, must implement it by June 2017, and the UK may do so earlier because of the Financial Action Task Force’s (FATF) international inspection of the UK in 2016. The FCA plans to consult upon its implementation this spring. MLD4 makes some big changes, including moving the focus to risk, with less emphasis on fixed procedures; the expansion of the politically exposed person (PEP) regime to domestic PEPs, including tax crimes; and for companies to record the identity of beneficial shareholders of 25% or more. UK firms’ duties under the UK’s Money Laundering Regulations will change.

- Some subsidiaries of US and Japanese firms have been asked to adopt global group financial crime policies. These are normally drafted for the parent company’s jurisdiction rules, and can cause considerable practical difficulties when applied outside, eg, in the UK. There are particular problems with obtaining new information from existing clients.

- Transparency International has assessed the UK’s anti money laundering regime and found serious weaknesses. For example, a third of banks dismissed serious money laundering allegations about customers without adequate review. While the financial sector has done well in producing Suspicious Activity Reports, there are persistent problems with compliance and awareness of how to make effective decisions.

- The US and the EU are considering new laws that will penalise businesses that fail to take measures to protect individuals’ data from hacking. This was highlighted in the attack on Talk Talk, where the losses may be as high as £60m. The problem appears to be particularly acute in smaller businesses. Alarmingly, only a small fraction of the IT spend is used for it, and a substantial minority do not train their staff to prevent it.

- Checking for customers or counterparties which may be on a sanctions list is becoming increasingly tortuous, given the differences in the lists maintained in different jurisdictions. For example, Iranian sanctions have been eased at different speeds. In theory, a UK firm should look only at UK sanctions, but that is not the reality for many UK firms, as Deutsche Bank has become the latest firm to find out in the US. Outsource providers’ data is often valuable but may not be complete.