When Mo Farah fell in the 10,000m final at the Olympics, he still went on to win gold. Imagine Usain Bolt had fell in the 100m sprint; he wouldn’t even have made the podium.

Your clients might not be Olympic athletes, but they know that when in the home straight, there’s little time to recover from a fall. What they might not realise is that the same applies to their pension savings, and guarantees could stop a costly stumble at the point of retirement.

For adviser use only – not approved for use with clients

When Mo Farah fell in the 10,000m final at the Olympics, he still went on to win gold. Imagine Usain Bolt had fell in the 100m sprint; he wouldn’t even have made the podium.

Your clients might not be Olympic athletes, but they know that when in the home straight, there’s little time to recover from a fall. What they might not realise is that the same applies to their pension savings, and guarantees could stop a costly stumble at the point of retirement.

Reducing investment risk with age

When speaking to clients, you’ll have discussed the importance of protecting their pension savings as they get older. Most clients will understand the need to gradually move the focus away from growth and to slowly reduce the investment risk.

Pension freedom offers a wide variety of choice, and makes it easier for clients to stay invested at retirement.

Weighing up retirement income options

Taking a pension pot as cash could trigger expensive tax liabilities, while the certainty of an annuity comes at the expense of flexibility.

There’s a lot of attention on the middle ground offered by guaranteed income drawdown and flexi-access drawdown solutions. These solutions create flexibility, maintain access to capital, offer an upside if investments perform well, and make it easier to bequeath what’s left on death.

But how can clients reap the potential benefits of staying invested, without exposing their baseline income to the negative impact of a steep fall in the markets?

Avoiding the negative impact of a late fall in the investment markets

Time smoothes out volatile investment performance, and, over the long term, equities have historically provided better returns than cash. Hence the heavy equity weighting generally advised for clients in the earlier stages of their pension saving journey.

Indeed, if investments are held for a period of 18 years, research (based on the past 115 years) demonstrates that stocks and shares are probably going to outperform cash 99% of the time[1].

Clients have to be aware that it’s very difficult to recover from a significant market downturn in the latter stages of their pension saving journey. If they’ve started taking an income from their pension, then it’s more difficult to recover.

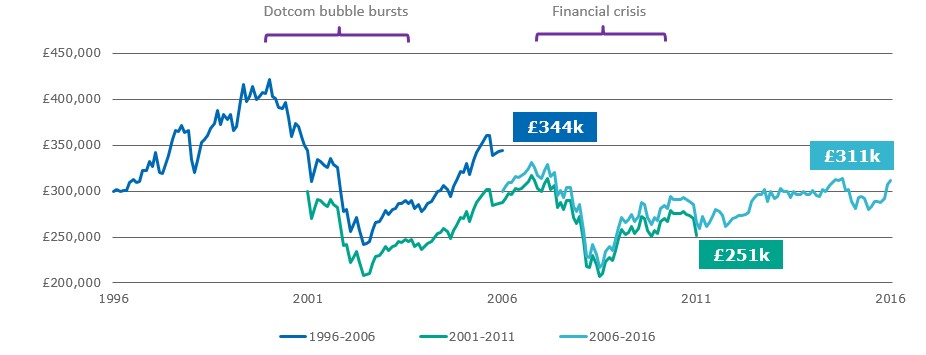

Below you can see the impact that a downturn in the markets can have on the value of a pension, the income it generates and/or the amount of time it will last.

The chart shows the outcome after 10 years for someone who invested £300,000 in ABI Mixed Investment 40%-85% Shares sector average, and took a yearly income of £15,000.

The investor who started taking income in August 1996 experienced strong returns early in retirement. Their savings were worth £44,000 more after 10 years. However, the investor who took income from August 2001, experienced negative returns early on. Their savings were worth £49,000 less after 10 years. This may leave investors concerned that their savings won’t provide enough income for the rest of their retirement.

Source: Morningstar, produced by Aegon, 10 years to end August. Figures in £s on a bid-to-bid basis with monthly payments and gross income reinvested based on investing in the Mixed Investment 40-85% sector average. Past performance is no guide to future performance.

Guaranteeing a retirement income that doesn’t cost clients flexibility

There are products available that offer clients the flexibility, as well as the ability to benefit from any rise in the value of their investments, without them giving up guaranteed income.

Solutions like Secure Retirement Income mean that if the market moves in their favour, clients can increase their income. It also ensures that, if the value of their investments falls to zero, they still receive the guaranteed income.

Without this guarantee, there’s little to shield clients from a significant downturn in the market at, or in, the early stages of retirement.

When your client is so close to the finish line it’s important they don’t fall at the last hurdle.

Any guarantee is based on the ability of Scottish Equitable plc to pay it. If it no longer existed, then the guarantee(s) would be affected.

[1] Source: Barclays Equity Gilt Study March 2016, Figure 8 p61

Aegon UK offers retirement, workplace savings and protection solutions to around 2,000,000 customers, and employs approximately 2,100 staff. Revenue generating investments totalled £59 billion as at 31 December 2014.

Aegon UK offers retirement, workplace savings and protection solutions to around 2,000,000 customers, and employs approximately 2,100 staff. Revenue generating investments totalled £59 billion as at 31 December 2014.

As an international life insurance, pensions and asset management company, Aegon has businesses in over 25 markets in the Americas, Europe and Asia.

Aegon are the only multi-channel platform provider in the UK, servicing the workplace, advised and direct markets.

With award-winning digital retirement services, Aegon was named one of the 30 most innovative companies in the UK in the Market Gravity Innovation Insider Index 2015.

Visit www.aegon.co.uk/advisers for more information.