The UK base rate is now at a 300 year low so many cash funds, are delivering negative returns to investors. It might be a good time to review whether cash is suitable in the current climate.

The UK base rate is now at a 300 year low and means that many cash funds, including the RLP Deposit Fund, are delivering negative returns to investors. If you have clients sitting in cash it might be a good time to review whether cash is suitable in the current climate.

We’ve seen a succession of macro-economic events over the summer inject significant doses of volatility into investment markets. From renewed concerns about Greece and the Euro zone, the implications of Brexit and the forever increasing drumbeat of the forthcoming US election.

Volatility has been on the rise and many investors may want to turn to money market strategies for the perceived security.

This behaviour can seem perfectly sensible and prudent amongst a backdrop of uncertainty but with the BoE’s recent decision to slash rates further to 0.25%, now may be a good time to remind your clients of the drawbacks of investing in ‘cash’ in the current climate.

Many money market funds, including the RLP Deposit fund, are currently producing negative returns due to the impact of the annual management charge (AMC) and low interest rates. At 0.25%, interest rates now sit at a level below our lowest AMC, and with talk of negative interest rates it seems likely that this trend will continue for the foreseeable future.

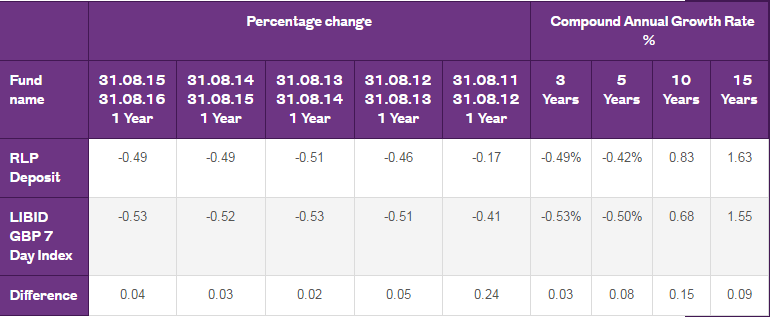

RLP Deposit fund performance

The following performance figures are net of 1.00% AMC:

We offer a range of different funds spanning different types of investments and risk profiles as well as a choice of multiple end points for our lifestyle strategies for you to choose from and recommend for your clients. We are living in uncertain times and the value of investment advice can go a really long way in this tentative landscape and prevent your clients from losing real value in their investments.

For further information on our investment options please read our guide or alternatively, contact your usual Royal London contact.

Source: Lipper, bid to bid, as at 31.08.2016. All performance figures, including the figures shown for the growth in the benchmarks, have been calculated net of the Fund Management Charge applicable for each fund. The Compound Annual Growth Rate (C.A.G.R.) is a measure of the investment returns, on a given fund, over the specified period. It allows for the impact of compounding of investment returns, which is particularly important where returns vary from one year to the next. Past performance is not a guide to the future. Prices can fall as well as rise meaning you may not get back the value of your original investment. Investment returns may fluctuate and are not guaranteed.

Find out more information about our fund range and investment solutions.

This is a Royal London promotion.

We're the UK's largest mutual life, pensions and investment company. When we first opened our doors in 1861, we wanted to help people to help themselves. And it’s been our way of thinking ever since. As a mutual, we're owned by our customers. So you can be sure that absolutely everything we do has their long-term interests in mind.

We’re on your side

We believe the best customer outcomes are achieved through a combination of value-for-money propositions and impartial advice. That’s why we design a wide range of pension and protection solutions with advisers at the heart of our processes.

We believe in personal service, so you can expect direct contact with our experienced staff. But we also believe in great technology - through our innovative online services, you’ll have your client’s details at your fingertips. You’ll be able to access information, track progress and make live changes to their plan with us.

Why Royal London for your clients?

We like to think your clients will feel the benefit of being part of Royal London, rather than anyone else. For example, we’ll aim to give your pension clients a share of our profits each year to boost their retirement savings.

Your protection clients will also have access to our value-added benefit, Helping Hand - a package of services designed to give them the practical and emotional support they need at difficult times in their lives. All at no extra cost.