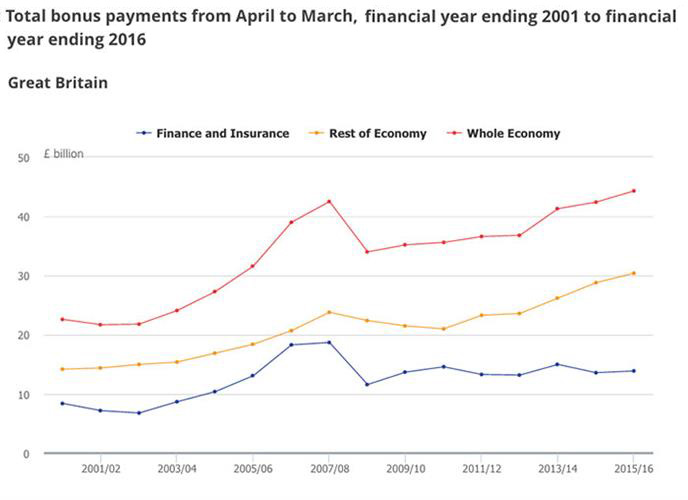

Bonus payments in the UK received £44bn in the last tax year, beating the peak reached before the financial crisis for the first time.

It has taken eight years, with the most recent figures improving by 4.4% on last year.

Industries poles apart“The largest single contributor to this record level of bonus payments was the finance and insurance industry, at £13.9bn, an increase of 2.2% over the year,” said the ONS press release, yet other industries have been the drivers of growth. ONS statistician Nick Palmer said: “The total of over £44bn of bonuses represents the first time that the figure has surpassed the previous record set in 2008, when it was £42.5bn. Although the finance and insurance industry retains the largest share of the total, other industries, particularly among professional and high-tech business services, have been the biggest drivers of growth since 2008.”

ONS report

Finance frenzyCity AM’s Emma Haslett describes the rise as a “frenzy”, adding that the data also indicates changing habits in bonus payment. “In the finance and insurance sectors, bonuses increased 2.2% to £13.9bn. That said, as a percentage of total pay in the sector, they dropped – from 23.1% last year to 22.7% this year.

This fall is more significant when compared to bonuses before the credit crunch. In 2007 it amounted to 34.1% of total pay. During March, the peak month for bonuses, they made up 54.6% of total pay in the sector. However this is still 12.8 percentage points below February 2008’s peak, when bonuses amounted to 67.4% of total pay.

Haslett also notes the differentiation between the private and public sectors: “By contrast, bonuses as a percentage to total pay in the rest of the economy have remained pretty stable – in the financial year to March, they made up 4.5% of the total, compared with the average of 4%. In the public sector, they made up just 0.3%. Ouch.

“What's interesting is that in the finance sector, bonus season has got later - whereas in the year ending 2014 it peaked in February; in 2015 and this year that peak came in March.”

Source: Office for National Statistics

CityAM article

Affected by legislation?The Telegraph

Source: Office for National Statistics

CityAM article

Affected by legislation?The Telegraph’s Tim Wallace added that the slowing rise in finance sector bonuses could be the effect seen from EU regulation that has sought to cut these to no more than 100% of their salary, awarded with shareholder agreement.

£44bn

Total amount of bonuses paid in 2015-16 tax year

“The rule has led some banks to increase basic salaries instead, and has also resulted in the introduction of fixed allowances, a payment which is typically made quarterly or annually and not treated as a bonus. However, banks hope that they will be able to scrap these fixed payments in the same way as they can with bonuses.

“By contrast British officials at the Bank of England believe banks should pay bonuses, partly because the awards are flexible and so can be cut easily if necessary, but also because the payouts are increasingly paid in shares and deferred for as much as a decade.”

The Daily Telegraph article

Seen a blog, news story or discussion online that you think might interest CISI members? Email jules.gray@wardour.co.uk.