Britain’s £200m sukuk issue last year was a milestone event for the country’s Islamic finance industry; it put yet further water between UK offerings in this field and other non-Muslim countries.

The UK regulator has authorised a number of fully Shariah-compliant banks since 2004. “That's what really sets us apart from the rest of the non-Muslim world,” says Stella Cox, Chair of TheCityUK’s Islamic Finance Market Advisory Group. “Elsewhere in Europe, the Islamic finance industry has focused on capital markets and ancillary service provision. But apart from the recent opening of a branch of a Turkish participation bank in Germany, there are no banking services from domestic, Shariah-compliant banks anywhere else. That is a very important point, as over the Channel, regulators have been struggling to fit authorisation of independent Islamic banks into their regulatory and legal codes.”

The sovereign sukuk issue demonstrated tight pricing, with no divergence from that of comparable gilts. “Most importantly,” says Cox, “it created a source of Triple A-rated, sterling denominated paper for banks' liquidity buffer requirements.” Britain’s Islamic banks had had no access to Triple A sterling denominated paper before the issue. “The fact that the issue was 11 times oversubscribed speaks for itself,” Cox says, “but, had it been £2bn, in my opinion it would still have been 11 times oversubscribed, as the paper fit equally well into requirements of any banks needing the right paper.”

Islamic finance in Britain dates back much further than 2014, to the 1980s. Cox, who in her day job has been MD of DDCAP group since 1998, has worked as a practitioner in Islamic finance for some 30 years. Previously a Director of Dresdner Kleinwort Benson with responsibility for Middle Eastern institutional relationships and Islamic product development from the mid 1980s, she was involved in structuring The Islamic Fund, the first Shariah-compliant global equity product.

In 2003, the UK Government began to intervene in the regulation of the market. Dr Valentino Cattelan, former Oxford University Scholar and author of

Islamic Finance in Europe, told

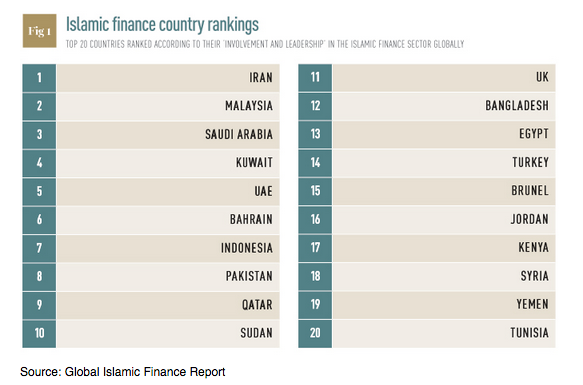

S&IR: “A number of legal and fiscal facilitations have been enacted in the UK to accommodate Islamic finance. These have certainly promoted the role of the UK in the transnational Islamic finance market.” Britain is now considered the leading European hub (see table below), with Luxembourg and Ireland also making strides towards establishing a level playing field for Islamic finance practice, but there is some way to go.

The rules

The rulesIslamic finance or, to be more accurate, Shariah-compliant finance, is a type of ethical funding that aims to share out the risk of doing business between all parties. Participants are prohibited from conducting or investing in business engaged in activities that go against the teachings of the Koran. So, organisations that make money out of gambling, brokerage, interest-based banking, and some forms of entertainment – such as satire and pornography – are definite no-nos, as are businesses that manufacture or distribute alcohol or pork products.

Dr Cattelan explains that while the prohibition of ‘ribā’ (interest), ‘gharar’ (unreasonable risk) and ‘maysir’ (gambling) are fundamental rules, for Muslim people, principles governing their financial activity extend a great deal beyond that. “Legal rules have to be connected to strategies of investments management in the light of the local economy,” he says. “Traditional market structures, as well as innovative ones – for example, venture capitalism – are framed in relation to broader considerations of distributive justice: for instance, through zakat (the compulsory giving of part of your income to charity).”

What is a sukuk?Sukuk is perhaps the most well-recognised Shariah-compliant instrument in Europe and the US. Like bonds, there are many types of sukuk, each with its own specific requirements. Two fairly common examples seen in Western transactions are al-Ijarah, which is mainly related to leased properties and assets, and is issued by the leased property’s owner, and al-Mudaraba, which is issued between a capital provider and another (the Mudarib) on the condition that the profit is shared at an agreed ratio.

The origins of Islamic finance date back some 1,400 years, but the iteration that is currently pervading the European financial landscape is young, spanning only about five decades. Since the 2008 financial crisis, the popularity of this ‘alternative’ way of doing business has risen exponentially – 2014 saw a 12% increase in the global market. As Ian Stewart, Chief Economist at Deloitte told the Symposium: “This is an intriguing time to look at sukuk in the UK. Policymakers want diversity in the market and people are interested in doing things in a different way.” A recent

survey by Deloitte’s Islamic Finance Knowledge Center backs up this claim. It found that 91% of Europe-based investors surveyed had considered ethical investments in sukuk. Harris Irfan, Managing Director of the European Islamic Investment Bank, added that many of the Muslim and non-Muslim students he meets “have seen what happened with the financial crisis and want a more ethical approach”.

Staggering potentialThe market, though currently worth a healthy $2tn, remains relatively untapped. According to

research by TheCityUK, Shariah-compliant assets comprise only 1% of financial assets worldwide, and yet over 20% of the world’s population is Muslim. The same research predicts that the market will reach $3tn by 2018. Europe is slowly waking up to the staggering potential.

Those figures may be in dollars, but the US is significantly lagging behind Britain in terms of both the number of financial institutions that offer Shariah-compliant services and educational bodies that run courses and degrees in the subject. In Britain, 20 banks provide Shariah-compliant services – that’s double the number than the US. Five of these banks are fully compliant, such as Al Rayan Bank, formerly known as the Islamic Bank of Britain.

Aiming highThere are plenty of success stories of highly profitable Shariah-compliant transactions in Britain, especially in the commercial real estate sector. A group of Qatari investors, for example, paid £150m for an 80% stake in London’s iconic Shard skyscraper. In 2012, a Malaysian consortium acquired another iconic building, Battersea Power Station, at a cost of £400m.

Real estate transactions are particularly successful within the Shariah-compliant framework, not least because many real estate borrowers are turning to wealthy Muslim finance providers for funding; people who would otherwise not be able to partake in such deals. It is also easier to structure this type of deal from a compliance point of view. As a result, the market is fiercely competitive. A far less concentrated market for Shariah-compliant assets is the equity market. But the downside there is that it is much harder to structure equity in line with Shariah principles. This may go some way to explaining why Shariah-compliant assets make up such a tiny percentage of the world’s total.

But also, Irfan says, in the current environment of nascent Western understanding of the market, despite growing education around the topic, there is little reason for large Western companies to issue Shariah-compliant instruments. “It is very difficult to persuade these companies, or even medium-sized companies, to issue sukuk,” he told the Symposium. “There generally has to be a link with an Islamic region like the Middle East or Malaysia. It just doesn’t make sense for a typical FTSE 100 company.”

And then there is the issue of regulation. To establish whether or not a financial transaction or product meets the necessary requirements under Islamic law, participants consult a Shariah Supervisory Board (SSB) that provides a fatwa. Contrary to some popular thinking, this is not a legal opinion. It is a report of validation (or otherwise) issued by the SSB of the practices and procedures of an institution or product (fund) under the Shariah stipulations, to which that firm or product is obliged to adhere.

As Cox points out, the UK regulator is secular and adopts the same, principles-based approach across all its regulatory supervision. “It does not include Shariah supervision in its process,” she says. “The scholars themselves are not involved in the management of a bank or firm and there is no key or controlled function classification for Shariah scholars in UK regulation. It is the directors and the senior management of a firm or bank that have accountability to the regulators. The only variance to that is if a member of a firm's SSB also had an executive position within it that fell under key and controlled functions.”

For instance, one of the UK Islamic banks has a member of its SSB who is also an Executive Director and its Head of Legal (regular) – the individual is qualified as a solicitor in England and Wales and also called to the Bar. His financial regulatory authorisation relates only to his responsibilities as Head of Legal (regular) and not Shariah.

Cohesion and common purposeRussia and the Commonwealth of Independent States – the former Soviet empire – are the latest big markets for UK expertise in Islamic finance. In November 2015, the National Bank of Kazakhstan – a Muslim majority country – started training for the CISI’s Islamic Finance Qualification as part of President Nazarbayev’s personal plan to make Kazakhstan the leading regional hub for Islamic finance. Russia – with more than 20 million Muslim citizens – has undergone a sharp volte-face on Islamic finance in recent months, with fresh and vocal support for the industry from major banks and senior politicians.

“There is currently an extraordinary degree of cohesion and a common desire among almost everybody to further the agenda collectively,” said Cox after a recent CISI symposium on Islamic finance in London. “I am not sure I have always experienced that throughout my career and I find it very motivating.” The gathering reflected this common purpose; there were contributions from some 29 speakers from far and wide, including some who had flown in especially to speak at the event from Bahrain, Kuala Lumpur and Washington.

Shariah-compliant assets make up only around 1% of the world’s financial assets; yet one in five people on the planet are Muslims. The math speaks for itself, the times they sure are changing.