When the art is decaying, the fine wine has been drunk and the bond market is crashing, gold will be there, sitting stoically in a vault somewhere, worth its weight in, well, gold.

Remarkably robust and consistently in demand, it’s no surprise that since the inception of financial markets, gold has been used as a hedging device against the financial system.

The first quarter of this year saw the price of gold surge. In February, when traders feared another financial meltdown and gold was valued at over $1,200 per ounce,

The Telegraph reported that buyers were “queu[ing] round the block” to purchase the precious metal.

But if gold is such a sure-fire bet, wouldn’t all the world’s potential investors be in the queue?

Here’s what you need to know before diversifying your portfolio into gold, according to Daniel Fisher, CEO and MD of Physical Gold, and Adrian Ash, Head of Research at BullionVault.

What are the potential rewards and expected risks?DF: As with any investment, the price of gold can fall as well as rise, so your gold may be worth less than when you bought it. There is also the possible opportunity cost of investing in gold – it doesn’t produce an income, so investors may feel they’re missing out on alternative opportunities. This risk is currently negligible, though, due to the low interest rate environment dictating very low interest on cash deposits.

There’s no counterparty risk if you buy physical gold coins or bars. However, there will be if you opt for mining shares, funds or exchange-traded funds (ETFs).

12%

The average annual return over the past decade Liquidity may also be a risk when purchasing physical gold. Similar to buying property, you need to ensure that you’ll have buyers of your asset. So, steer clear of obscure types of gold or very old coins.

As gold provides no income, the desire is for capital appreciation. In very volatile economic markets, wealth preservation is the main focus rather than capital growth. Simply keeping pace with inflation will ensure wealth preservation. However, many investors will seek more ambitious returns. Average annual returns over the past decade have been around 12%.

AA: All things being equal, gold should return zero. It doesn't ‘do’ anything (it doesn't even rust) and industrial use of gold has fallen to 10% of total demand in recent years, according to specialist analysts Metals Focus.

Bullion is the only asset you can trade and settle as physical property in a deep, global market, so it offers security of ownership, liquidity and diversification – financial insurance, in short.

Who are the market drivers – the buyers and the sellers?DF: The UK market has evolved over the past ten years. There are now lots of dealers to buy and sell from, and online shops are common. Awareness of the market has increased, although the level of knowledge among buyers varies greatly. We’re seeing more institutional buying from pension and hedge funds, and central banks gradually shifting away from their reliance on the US dollar towards gold.

What have been some of the big trends in the market? AA: There has been a rebound in professional sentiment recently, due to macroeconomic uncertainty around US interest rate hikes, for example. Prices leapt in the first quarter of the year, with hedge funds' net long position on the Commodities Index growing at a record-breaking pace.

Another trend is the increased number of new private investors entering the market, and gold miner hedging has turned sharply higher too, but from a very low base.

How has the low interest rate environment affected gold investment?DF: With ISA and savings rates at (or near) 1%, gold has proven a popular alternative. Gold can provide a tax-free store of wealth, without the annual limits of an ISA.

AA: Gold's long history as money means that its lack of yield and low cost of carry make it highly sensitive to interest rates. It's not interest rates alone that matter, but the real rate that the investor receives after accounting for inflation.

Stronger consumer prices index inflation meant real US rates went down after creeping above zero in 2015 for the first time in six years. That boosted the appeal of rare, indestructible gold.

What’s the experience like for holders? DF: For those who take delivery, they can enjoy the comfort of having direct access to their gold. Its tangible nature means the holder can literally feel their wealth. If kept at home, the holder will need to ensure adequate insurance (more on this below). Retail coins and bars won’t lose value simply because you take possession. Most coins are 22 carat and maintain their integrity. But if the gold gets scratched, it can affect its sell-on value.

Opting for the dealer’s insured storage option can be an easier route. But investors should ensure the gold is held on a segregated and allocated basis. This means it’s not leveraged (what you bought is being held).

Gold requires no care beyond security and insurance.

AA: The experience will depend on the investor’s aims, expectations and timing. Shorter-term traders will want to watch interest-rate expectations and sentiment in equity markets. Long-term ‘insurance’ buyers will simply want to rebalance with other holdings, mindful that gold prices peak when investment stress is high and bottom when it’s low. The Dotcom Bubble, for example, saw European central banks sell gold at $250 per ounce. In summer 2011, when US debt was downgraded, the European sovereign debt crisis was at its peak and the London riots devastated local businesses, the gold price was $1,900 per ounce.

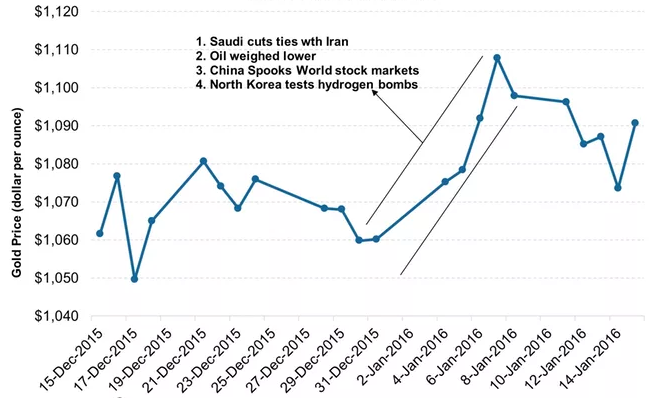

Gold price fluctuations December 2015–January 2016

Source: Commodities Index

What are the regulatory and tax considerations when investing in gold?DF:

Source: Commodities Index

What are the regulatory and tax considerations when investing in gold?DF: Gold only falls within the Financial Conduct Authority’s remit if it is securitised – that is, if it is bought through a paper asset such as an ETF, a gold fund or a mining share. But the buying and selling of physical gold is unregulated. There is no VAT on investment-grade gold in the UK. To qualify, gold must be at least 22 carats and in the form of a coin or bar, so that excludes jewellery and gold dust.

Profit made when selling foreign coins or bars will be liable to capital gains tax (CGT). However, if a UK resident profits from the sale of UK coins, there’s no tax to pay because the coins are classed as legal tender – reducing tax exposure can be another reason why investors buy physical gold.

AA: In addition to that, sale of goods and property law apply. The wholesale market in London is regulated by the Bank of England's Non-Investment Products code.

What are the costs of storing gold?DF: Some home insurers will cover a modest gold holding for a very small premium. Alternatively, gold can be stored with 24/7 access at third-party safe-deposit facilities for around £150 per year. Most dealers offer a professional vaulting service, which will include full insurance. Prices for this service are around 1% per year.

AA: The large Good Delivery bars of gold you’ll see in

The Italian job are produced by a small number of closely monitored refineries and weigh 12.5kg. Good Delivery status signifies that there's no question over quality or weight when delivery is made. Bars must be stored in recognised vaults to retain the status. For a typical holding of £10,000, storage can be below £35 per year.

What are the pricing and liquidity considerations? Can investors sell and buy with confidence and ease?DF: The key to securing good liquidity and a high selling price is to buy the right type of gold in the first place. Gold can be as liquid as cash and there are lots of dealers to sell to. Unlike many alternative asset classes, gold can be sold and realised within days.

You can opt to sell privately to gain the highest prices but this takes effort. Selling to your local jewellers is simple but they may just intend to melt the gold down, affecting the price.

To combine ease with price, sell to a professional dealer, preferably the one you originally bought from. The price you’ll receive will depend on the underlying gold price at the time, the weight of the gold and in which form it’s held.

Meet the experts

Daniel Fisher is CEO and MD of Physical Gold and a member of the CISI. He has 20 years' experience in finance, spending much of that time working within the new issue fixed-income business at a top-tier US bank.

Adrian Ash is Head of Research at BullionVault. He was formerly Head of Editorial at Fleet Street Publications, which publishes regulated financial advice for private investors.For example, buying a large 1kg bar means, as a holder, you have no flexibility to sell part of your holding. It’s all or nothing. Also, the dealer’s price will reflect that they will need to sell it to one buyer. If you held 1kg of gold in small UK coins instead, you could sell one coin for a far higher price. This is because coins are more desirable and sellable, and tax free.

Generally, physical gold should be held for the medium to long term. Its price can go down from one year to the next and there’s a bid/offer spread to overcome. Gold tends to move in the opposite direction to many mainstream asset classes, making it an attractive hedge by providing portfolio balance.

One argument is that a portion of your wealth should always be held in gold as we cannot predict the next market crash. Right now, gold has returned 20% in 2016 alone, outperforming every other asset class. However, prices are still 30% off their peak a few years ago.

Is there a measure of asset class performance and is it reliable and fair?DF: Following the London Bullion Market Association (LBMA) gold fixings can help analyse performance and they are formally regulated as a systemically important benchmark.

What is the cost of buying/selling gold?DF: Gold operates on old-fashioned economies of scale. The more you buy, the lower price you’ll pay for its weight. Apart from central banks, no one can buy at the quoted spot rate. This is used as a benchmark from where buy and sell prices are derived. The bid/offer spread will vary according to the quantity, but also the type of gold.

For example, buying a single collectable coin may present a 20% spread. Whereas buying £50,000 worth of bullion coins may bring the spread down to low-single digits. Most dealers won’t charge a commission for buying and selling – they make their margin from buying wholesale and selling retail.

AA: As gold is financial insurance, it's vital you check the exits before you go in.